Eugene and Patricia Kline — formerly Centerville residents but now living in Eaton — sued to recover what they argue were improper legal fees and costs charged to them when their home was foreclosed.

LOCAL ECONOMY: Dayton region bright spot: Thousands of jobs announced this year

The couple acknowledge they twice defaulted on loans secured by two mortgages on their Centerville home. Though they paid off the loans, they found themselves facing a web of costs and fees they say didn’t make sense.

A tangle of legal confusions followed. At one point in the process, the Klines weren’t even sure who held their mortgages.

“It takes almost an accountant to figure out this kind of craziness … this is happening to people all over the country,” Patricia Kline said.

MORE: Disruptive force: Three things to know about Aldi

One sign of the confusion, as the Times reported: Even though Wells Fargo held both loans taken by the Klines, Wells Fargo sued another company for holding one of the loans, all the while charging court costs and fees to the Ohioans.

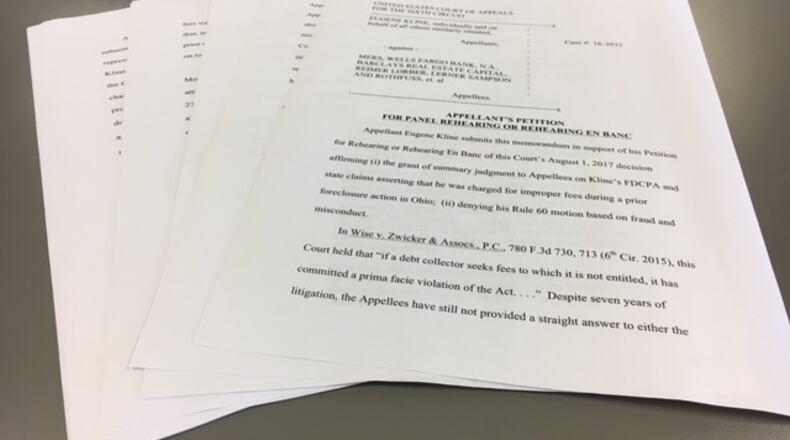

Today, the case is mired in the U.S. Court of Appeals for the Sixth Circuit, and the Klines are fighting an earlier affirmation of a summary judgment for the appellees or respondents, which include Wells Fargo and other entities.

“Despite seven years of litigation, the appellees have still not provided a straight answer to either the appellant (Eugene Kline) or the courts as to which fees and expenses they collected from appellant at the time he paid off the loans at issue in November 2007,” Kline’s lawyers wrote in a court filing.

New York attorney Paul Grobman, who represents the Eaton couple in the case, said the lawsuit highlights “a whole host of problems that sort of spun out of control” from the foreclosure crisis.

According to the Federal Reserve Bank of St. Louis, as many as 10 million mortgage borrowers may have lost their homes in the foreclosure crisis spurred on by the Great Recession of 2007-2008.

And while the crisis itself seems to have faded from view, a lingering hangover remains. The number of renter households has hit a 50-year high, according to the Pew Research Center, and the Klines are among them.

Patricia Kline says she and her husband rent from a friend in Eaton, because their foreclosure will not allow them to buy another home.

“People have a right to know how much they’re paying for fees and expenses,” attorney Grobman said in an interview.

It’s illegal in Ohio for banks to charge homeowners attorneys fees, Grobman said. “Banks and the most esteemed banking institutions in the country … are misrepresenting fees and expenses,” he said.

“I cannot express to you what a travesty this has been,” Patricia Kline said.

“I just want them to make it right,” her husband said.

A spokesman for Wells Fargo, Tom Goyda, said the bank seeks to prevent foreclosures whenever possible. But sometimes, institutions have no choice.

"We have consistently denied the claims in this case, and every court that has ruled on this so far has come to the exact same conclusion," Goyda said.

About the Author