The office, which would be called the Pension Rehabilitation Fund and be placed inside the U.S. Department of Treasury, would supervise the loans that would come from the sale of U.S. Treasury bonds from private investors. Brown hopes to attach the bill to a larger spending bill expected to be passed at the end of the year by Congress.

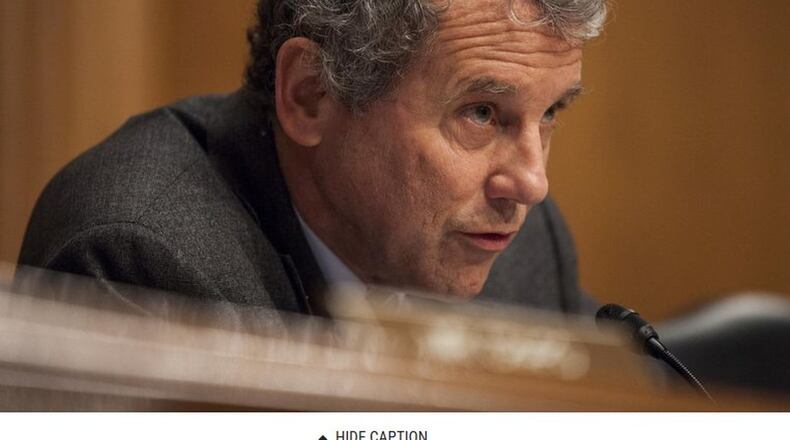

“All of you here today and the thousands of retired Teamsters, miners, builders, and others across Ohio earned your pensions over a lifetime of hard work,” said to those in attendance. “Now those pension plans are underwater. It’s bad enough that Wall Street squandered workers’ money – and it’s worse that the government that’s supposed to look out for these folks is trying to break the promise made to these workers.”

“Not on our watch,” Brown said. “We won’t allow that to happen.”

Most of those impacted are Teamsters covered by the Central States Fund, a multi-employer fund that serves trucking companies and covers 400,000 retirees across the country. Central States has warned it might have to cut pensions by an average of 22 percent for retirees because it has $35 billion in liabilities and just $17.8 billion in assets.

But the bill also is aimed at propping up a number of other pension funds, including the United Mine Workers Pension Plan, the Ironworkers Local 17 Pension Plan, the Ohio Southwest Carpenters Pension Plan and the Bakers and Confectioners Pension Plan.

About the Author