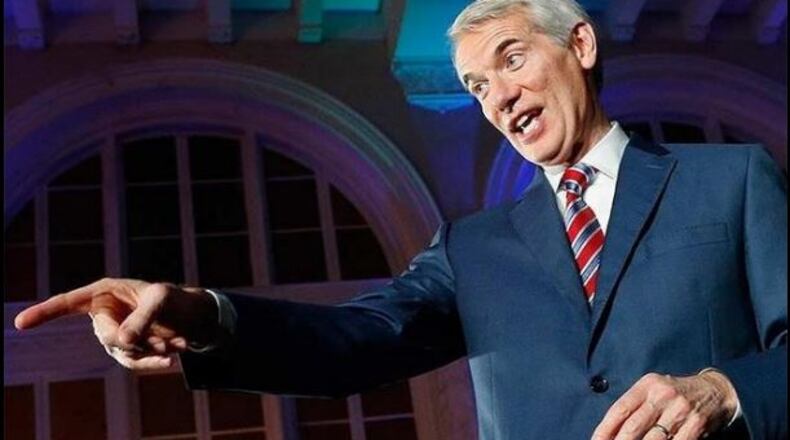

“Tax reform is about more jobs and better wages, and this is a sign hat we are making progress with our friends in the House and the Trump administration,” he said in a statement. “Tax reform will give our economy a shot in the arm, and I’m committed to working with my colleagues to get this done to benefit Ohio and our country.”

Meanwhile in Washington, D.C. Rep. Kevin Brady, the Texas Republican who chairs the House Ways and Means Committee, said tax writers in the White House, Senate and House remain on schedule to produce a plan that can be voted on in 2017.

“It is an ambitious schedule. We recognize that,” he said.

While Brady reiterated that the goal is a permanent tax rewrite because it would stimulate the most robust growth for the longest period of time, he didn’t rule out a temporary tax cut. “We’re going to deliver tax cuts and tax reform in some form,” he said. He said he has reached out to congressional Democrats about tax policy, but he rejected their call to abandon any tax cuts for the top 1 percent of earners, saying the planned tax overhaul is “all about growth.”

House Speaker Paul Ryan’s office sent an email Wednesday saying if lawmakers are serious about growing the economy, then tax cuts should be permanent.

Brady also said he didn’t want to wait to require companies to bring back earnings that they have stockpiled offshore and was looking at the repatriation proposal outlined in the 2014 tax plan from former House Ways and Means Chairman Dave Camp.

A key Democrat said Wednesday that Republicans should abandon their plans to rewrite the tax code on a partisan basis and instead use their power to confront the president.

“Instead of teaming up with Trump to obtain more costly tax breaks for the super rich, they need to lay out a plan to contain Trump,” said Rep. Lloyd Doggett of Texas, the top Democrat on the Ways and Means tax subcommittee. “Only hours after he included among his ‘very fine people’ those who march in torch-lit processions shouting racist and anti-Jewish slurs and carrying Nazi flags, this is certainly not a time for more ‘business as usual.’ ”

The Associatied Press contributed to this story.

FIVE FAST BUSINESS READS

• Target to introduce 3 new brands in August, September

• Store openings and closings: What's going on in local retail?

• 5 new restaurants and retailers coming to The Greene

• Workplace incivility, aggression impacts more than half of US workers

• Itchy eyes? You're not alone. It's hay fever season in Southwest Ohio

About the Author