Last year, about 160,000 Ohio taxpayers filed state returns on Tax Day, just hours ahead of the deadline, officials said.

Taxpayers who need more time to prepare a federal or state return can file for extensions with the IRS.

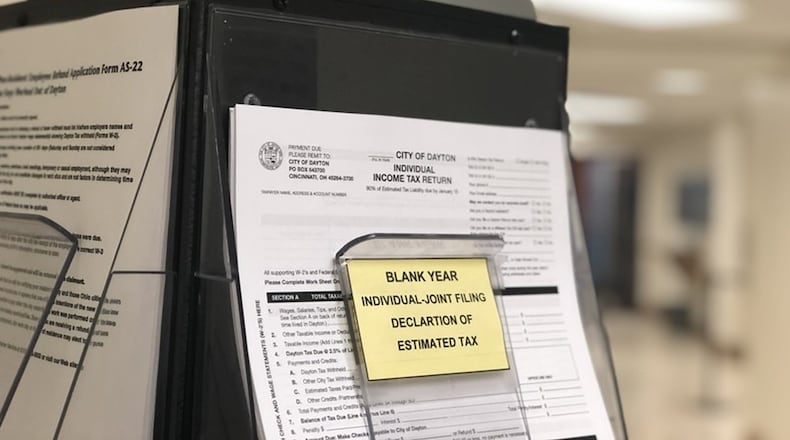

People who work in Dayton need to request an extension from the city, and other communities have similar requirements.

“We encourage people to call in and file, even if they can’t pay, because they can get set up on payment plans that will help take care of the penalty,” said C. LaShea Lofton, Dayton’s deputy city manager and finance director.

MORE: Tax Day is July 15. Here’s what you need to know

The IRS, the Ohio Department of Taxation, the city of Dayton and other local communities decided to extend the deadline to file income tax returns from April 15 to July 15.

The change was intended to give taxpayers some extra time and relief as they dealt with the economic and social impact of the coronavirus crisis.

As of July 10, the Ohio Department of Taxation received 5.088 million personal income tax returns, which is down 7.4% from the same point in 2019, according to department data.

Ohio typically has about 5.5 million tax filers.

Ohio Tax Commissioner Jeff McClain urges people who have not yet filed to file electronically, to simplify the process.

Filing online cuts down on errors and processing times, which leads to refunds being issued more quickly, he said.

State refunds requested via electronic returns are usually sent out within 15 business days, while refunds requested via paper return take about eight to 10 weeks.

Many people have been laid off during the COVID-19 shutdown or face other economic woes.

Complete coronavirus coverage by the Dayton Daily News

Some taxpayers have contacted the Ohio Department of Taxation saying they are unable to pay the taxes they owe at this time, said Gary Gudmundson, a department spokesman.

The important thing is that they file on time, or seek an extension, to avoid financial consequences.

“Pay when you can, but make sure you file your return, because then you are avoiding a potential penalty or interest charge for failing to file,” he said.

Ohio taxpayers who want more time to file a state return must request an extension with the IRS, and if approved, the state honors those extensions, Gudmundson said.

Last-minute filing is fairly common in Ohio and nationwide. Last year, the IRS estimated just days before the filing deadline that about 50 million U.S. taxpayers still had not submitted their federal tax returns. Years ago, the IRS said about one in five taxpayers wait until the final week to file their returns by the normal deadline.

A couple of weeks ago, the city of Dayton already had processed nearly 13,000 annual tax returns, which is about average for that point ahead of the deadline, said Lofton.

This month, the city has seen customer traffic, call volumes and other activities related to income tax filings at levels comparable to most Aprils of normal years, she said.

Most people who are owed refunds file early, while many who owe money file closer to the deadline, often at the last minute, she said.

People who don’t owe any money, or “no-pays,” typically file throughout the year, she said.

Taxpayers in Dayton should file city returns even if they think they don’t owe money to make sure they didn’t make a mistake in their calculations and actually are due a refund or owe money, Lofton said.

The city audits federal and state tax returns to ensure the city receives all of the tax payments it is owed, and everyone who works in the city should file a return, she said.

In Dayton, late returns can be subject to a $25-per-month penalty, up to a maximum amount of $150, and unpaid tax balances are subject to a 15% penalty, as well as interest, Lofton said.

Workers in Dayton who need an extension should contact the city, which also offers payment plans, she said.

About the Author