• Find out about a seller's return policies. Ohio's consumer protection laws permit sellers to establish their own return policies, including "no returns," as long as they inform you before you make a purchase.

• Determine if exclusions or limitations apply. Special promotions or offers should clearly disclose whether quantities of an item are limited, if a sale is only valid during certain hours, or any other terms or conditions.

• Know the details about gift cards. Most gift cards generally last at least five years, but fees that reduce their monetary value can vary depending on the type of card. For example, the value of a prepaid, network-branded card that can be used almost anywhere may decline more quickly than a single-store gift card.

• Ask about raincheck availability. If a product sells out at an advertised price before you're able to respond, you may be entitled to a raincheck. However, if a merchant clearly indicates that a limited number of specially priced products are available or that no rainchecks will be issued, they're under no obligation to provide one.

• Consider paying with a credit card. Using a credit card for purchases generally provides greater protection than other forms of payment. For example, your responsibility for unauthorized charges is typically limited to $50. Also, you can dispute charges that you may not be able to contest with cash or even a debit card.

Charities and non-profit organizations are quick to encourage holiday generosity to their causes; most do good work and provide valuable services to the community. Unfortunately, a handful of unscrupulous fundraisers are always willing to take advantage of donors’ good will.

To make the most of your hard-earned charitable contributions, I urge you to:

• Develop a giving plan. Determine in advance which charities you want to support. Inform unexpected or unwanted solicitors that you already have a giving plan in place or that you need written information to evaluate their request.

• Research charities. Find out if an organization is registered with the Ohio Attorney General's Office, verify its tax-exempt status with the IRS's Exempt Organizations Select Check, and gather information from the Better Business Bureau Wise Giving Alliance, Charity Watch, Charity Navigator, and GuideStar.

• Ask how your donation will be used. Some charitable giving requests come from professional solicitors who are paid to collect donations. By law, solicitors must identify themselves, so ask them what percentage of your donation will actually go to the charity.

• Watch for red flags. Be wary of high-pressure tactics, requests for checks to be made out to an individual rather than a charity, or people who are unable or unwilling to answer questions about their organization. Don't give your credit card number of personal information to callers who contact you unexpectedly.

With some common-sense precautions, holiday gift and charitable giving can be meaningful and hassle-free. For more information about consumer rights or our state’s laws regarding charities, go to www.OhioAttorneyGeneral.gov or call 800-282-0515.

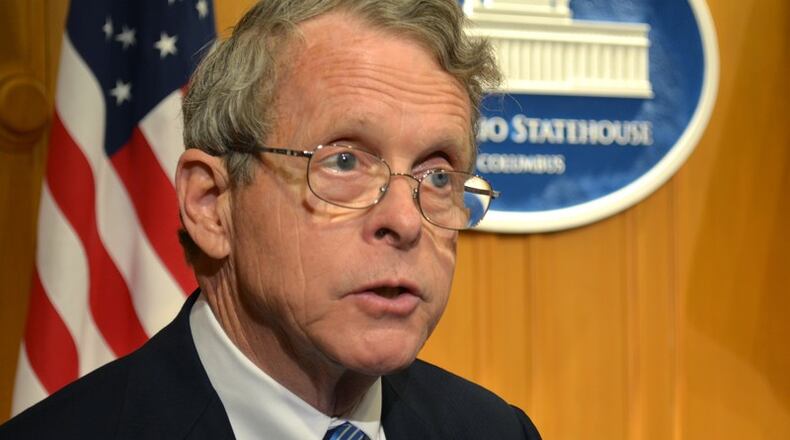

Mike DeWine is Ohio attorney general.

About the Author