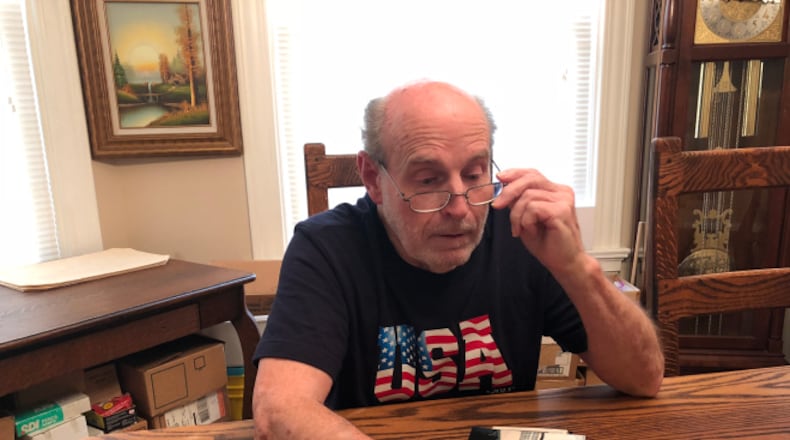

He worked for Chrysler for 31 years, and when he retired, he embarked on a second career as a locksmith. He had his Chrysler pension, social security and a tidy home in Monroe — everything he needed for a happy life.

Then, the illness hit. It hit suddenly and violently as Reed vomited in his bathroom.

“It looked like someone was slaughtered in there,” he said.

“I was just sitting in the living room and I really felt (it) just coming on real fast. I knew something was going to happen; I felt like I was going to throw up.

“I (ran) ... got just inside the door. Didn’t even get to the toilet. And it just splattered. It hit both walls and the back wall. I had when I went to the hospital they had to give me a blood transfer. You know, ‘cause I threw up that much.

“It was the blackest, blackest blood I’d ever seen in my life. Just pitch black. Didn’t look like blood, I mean, just looked like, well, more like tar.”

Reed had never seen so much blood at one time.

“So when I got to the hospital they said, ‘Well how in the heck did you make it in here?’”

An unexpected bankruptcy

Reed would later find out he needed a liver transplant. The ensuing medical bills, which have already totaled more than $110,000, would cause him to declare Chapter 13 bankruptcy, which allows someone with a regular (or disposable) income to plan a way to partially (or completely) pay his or her debt in three to five years, according to uscourts.gov, the website for United States courts.

Reed lives on social security. What’s left of his pension from working at Chrysler goes solely to making monthly payments on his medical bills, which range from $800-1,000 a month.

As he bluntly said, “Well, yeah (the medical bills have) cleaned me out.”

Reed’s story isn’t unusual. According to a Forbes article, based on a 2015 Harvard University study, medical bills are one of the primary reasons retirees fall into poverty, “medical expenses account for approximately 62 percent of personal bankruptcies in the U.S.

To make matters worse, studies indicate that seniors are the fastest growing demographic in bankruptcy filings and a whopping 72 percent of those who filed due to medical expenses had some type of health insurance.”

Leonard Fleck, professor of philosophy and medical ethics in The Center for Ethics (College of Human Medicine) at Michigan State University, is a leading voice in health care ethics with numerous published works. He is of the opinion that very high deductibles and copayments are a large source of the problem in regards to medical bills.

“Half of Americans have savings of $500 or less,” he said. “So bankruptcy is very easy.

“The basic problem is that we have for the past 50 years had a problem with escalating health care costs. We have gone from spending $26 billion on health care in the United States in 1960. That was for everybody who had a health problem. (It was) $3.3 trillion last year. (Health care cost increased) from 5.2 percent of our gross domestic product (in 1960) to about 17.8 percent of our gross domestic today with projected increases to 20 percent by the year 2021.”

Liver troubles

This downhill slide of escalating health problems and medical bills began for Reed four years ago when his liver problems started. A year later, this terrifying situation re-occurred, but by then he was already getting treatment for his rapidly failing organ.

Reed was diagnosed with non-alcoholic cirrhosis, despite him never drinking alcohol.

“I don’t smoke. I don’t drink ... I don’t even swear but that doesn’t have anything to do with it,” he said.

Despite his disciplined lifestyle, he needed a liver transplant. He would get it in 2015.

Reed has had health problems most of his life, from his early 20s until today. It began when he experienced sharp pain in his muscles, which gradually got worse over the years. Throughout that time, he went to doctors periodically in order to find out what the issue was, but he couldn’t get a solution or answer that made sense to him. Several different doctors diagnosed him with various problems like rheumatoid arthritis, fibromyalgia, even a mental health issue.

“I’m not the type of person to get mad, okay. But I told them ‘What is wrong with you’? Especially when they wanted the psych test,” Reed said.

“With all your knowledge, why can’t you admit you don’t know? I said that to Cleveland (Clinic), Mayo (Clinic) ... I don’t like doctors who won’t admit they’re wrong. You know, just say ‘I don’t know’ ... especially when I said, ‘Take a muscle biopsy.’ There I am, a layman.”

Reed finally did find a doctor he could trust, whom he met through a friend. After ordering a muscle biopsy, Dr. R.L. Lautzenheiser said that he had polymyositis. Polymyositis is a rare muscle disease which causes muscles in the body to become irritated and inflamed where they then become weakened, according to Johns Hopkins Medicine Health Library.

This condition required him to take more medication on top of the large quantity of pills he was already taking for the pain he was dealing with from previous errant diagnoses. In his view, this is what led to his liver failing. Due to his liver transplant and polymyositis, now Reed has trouble walking.

When he was recovering from his transplant, his daughter Dawnielle, 54, lived with him for three months as his caretaker. During his recuperation, he had to learn to walk again.

Reed said in admiration, “What a daughter. How many daughters would do that?”

A hard-working life

Throughout his life Reed said he was always a hard worker. He was born in Wabash, Ind. Although his father, Herman Reed, was small of stature at 5-foot-7, he was strong and silent.

“I never heard him ever utter to my mother, kids, any of us that he loved us” Reed said. “Now – he was a good father. He was a worker. And I appreciated that.”

His father had a lot of different skills, but he didn’t share them with Reed and his siblings. Reed flipped that scenario with his own children by always being willing to share the skills he had or “tricks of the trade,” as he likes to say.

While Reed grew up in Wabash, he worked many different jobs; including, working on a farm and at an A&P grocery store in college. Reed went to many different schools over the years but never attained a degree. He just wanted to take classes to acquire knowledge and skills. His daughter feels that with all the classes he has taken over the years he most likely has the equivalent of a Master’s degree.

Eventually, Reed settled in Kokomo, Ind., where he worked for Chrysler. He worked in many different departments, among them: tool engineering, payroll, bookkeeping, and accounts payable.

“Every job I had, I replaced two people,” Reed proudly shared of his work ethic.

Reed was with Chrysler for 31 years from 1962-93. Throughout the latter half of his career there, he started a side business as a locksmith. He first started out of his garage, but the success of his business bloomed so much that he moved into a building.

At the high point of his locksmith business, he had 14 employees. The total hours he worked between both jobs was around 12-14 hour per day, six days a week. He didn’t mind, because he loved to work and never slept more than three or four hours a night, something he attributes to a constantly roving mind.

“Challenge. Everything to me was a challenge,” he said. “Anytime I (saw) somebody do something, I wanted to do it better.”

At the pinnacle of his earning power at Chrysler, he made close to $89,000 a year. He is especially proud of this since it occurred in the late 1980s and early 1990s.

Reed used his high income to provide expansively for his family, which he had begun when he was only 19 years old. He helped design a house that they enjoyed even if he might’ve missed out on some of the enjoyment himself because of his strict devotion to work.

After his retirement in 1993, Reed worked at a flea market in Daleville, Ind., during the mid- to late-1990s. There he used his locksmith skills in manufacturing keys of all types. A poor entrance from the highway made him feel that his post-retirement business was suffering. So he eventually landed in Monroe, around the time of the housing crisis of 2007-08. This was because he had already landed a booth years earlier at another more established flea market in Monroe called Traders World off of interstate 75.

He worked at Traders World until a few years ago, when his polymyositis flared up and then culminating in his liver failing. He sold his business well below market value to try and help pay the cost of his medical bills.

The kindness of his neighbors, who help with him physical chores, has lightened his load. But to someone with his determination and drive, his day to day existence has been hard. He has repeated visits to the doctor weekly to monitor his liver and polymyositis. And he always has to monitor his finances in regards to his living expenses.

Despite all his hardships Reed remains extremely positive and happy. And just recently he finally began mowing his yard again using his push-mower for extra balance.

“Oh, man,” Reed cheerfully laughed. “I was elated. I mean it was joyful. I don’t know how to say it. Because I could actually do something again.”

About the Author