"Enacted in 1924, in the wake of Congressional attempts to investigate agency wrongdoing in the Teapot Dome corruption scandal, Section 6103(f) was intended to provide the Committee with unfettered access to tax return information necessary to carry out its broad mandate to oversee Treasury, the IRS, and the Nation's tax laws," the committee's lawsuit states.

Top administration officials have made no bones about their feelings about the request for multiple years of personal and business tax returns for Mr. Trump.

"Congress's investigative power is not unlimited," Secretary of Treasury Steven Mnuchin wrote in an April letter to the House Ways and Means Committee, arguing there is no 'express power' in the Constitution which allows the Congress to investigate the Executive.

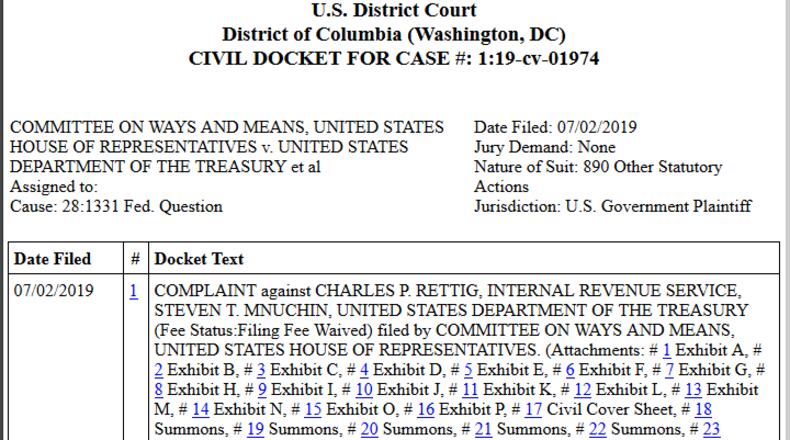

But the language of the tax code is very direct, naming the House Ways and Means Committee as one of three Congressional panels which can request, and receive tax information.

Democrats argue the failure of the IRS to turn over the President's tax returns, "is depriving the Committee of information necessary to complete its time-limited investigation, thereby impeding its most basic constitutional functions."

About the Author