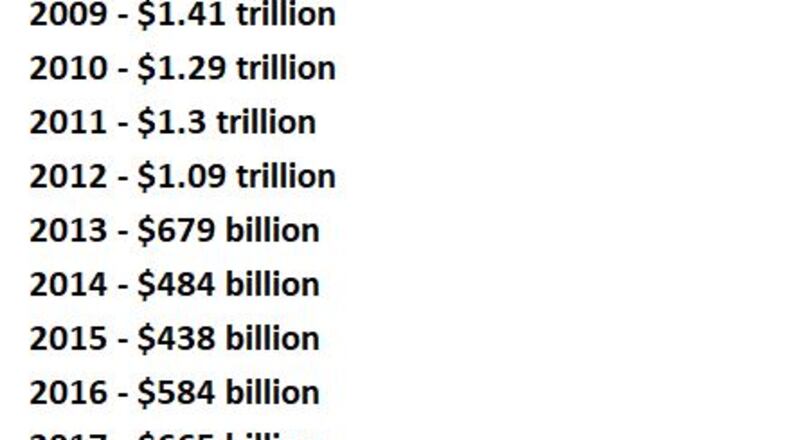

The deficit has grown in each of President Trump's two years in office - hitting $665 billion in 2017, and growing to $779 billion in 2018 - the biggest yearly shortfall for Uncle Sam since 2012.

"Since 2007, federal debt held by the public has more than doubled in relation to the size of the economy, and it will keep growing significantly if the large annual budget deficits projected under current law come to pass," the Congressional Budget Office recently reported.

Contrary to the predictions of many GOP lawmakers and the White House - the tax cut enacted at the end of 2017 by Republicans did not do anything to reverse the tide of red ink, as revenues in Fiscal Year 2018 were only slightly higher than the previous year.

Inside the White House, the deficit was not among the Republican talking points for President Trump - a major change from how the GOP dealt with large deficits under President Barack Obama.

ABC News reported last week that Acting White House Chief of Staff Mick Mulvaney told backers that 'nobody cares' about the deficit - as the issue did not make the cut for the President's speech - though, Mr. Trump has never mentioned the budget deficit in any of three appearances before a Joint Session of Congress.

While many voters believe the Congress is to blame for out of control spending, the part of the budget which the Congress directly controls is not the real driver of the deficit - instead it's the increasing costs for the major entitlement programs of Medicare, Medicaid, and Social Security.

As you can see in below pie chart from the Committee for a Responsible Federal Budget, the portion of the spending growth directly dealt with by lawmakers in recent years covers the portion for 'Defense' and 'Non-Defense Discretionary.'

"Of the $2.6 trillion projected increase in spending between 2019 and 2029 under current law, 31 percent is due to the rising costs of Social Security, 23 percent due to the rising costs of Medicare, another 12 percent due to other health care programs, and 21 percent due to rising interest costs," the CFRB wrote this past week.

To address the costs of Social Security and Medicare, the arithmetic is pretty simple - either you restrict the benefits going to those receiving them (reduce benefits), find ways to bring in more money (mainly more through tax revenues), or a employ a combination of those two options.

None of them are politically appetizing.

On Capitol Hill, what was once a high profile issue for Republicans - balancing the budget - has faded into the shadows.

A small group of GOP lawmakers recently introduced a Balanced Budget Amendment, but it went nowhere with the GOP in control of the Congress, and seems unlikely to go anywhere now.

"Unless we want to bury our kids and grandkids underneath a mountain of debt, we must force fiscal responsibility through a Constitutional Amendment," said Rep. Barry Loudermilk (R-GA), one of ten sponsors of a balanced budget change to the Constitution.

About the Author