A word to the wise: Don’t assume regular payments aren’t due, however. It’s a good idea to check with your bank or institution on details before altering your own payments.

And customers should not be surprised if many retail lobbies are closed. Many banks and credit unions are operating in a drive-through or ATM mode only. Often, employees and bankers are reachable by phone. Again, check with your bank.

Beginning today, PNC Bank is operating primarily in a drive-up only mode, with select branches that do not provide drive-up capability, PNC said.

"Together, about three quarters of PNC's current branch locations will remain open to service customers," PNC said in an email. "The remainder of PNC branches will be closed until further notice. To locate a PNC branch, customers may visit the PNC branch locator" at https://apps.pnc.com/locator/#/search

PNC branch hours will be 10 a.m. to 5 p.m. Monday through Friday and 9 a.m. to 1 p.m. Saturday, closed on Sunday.

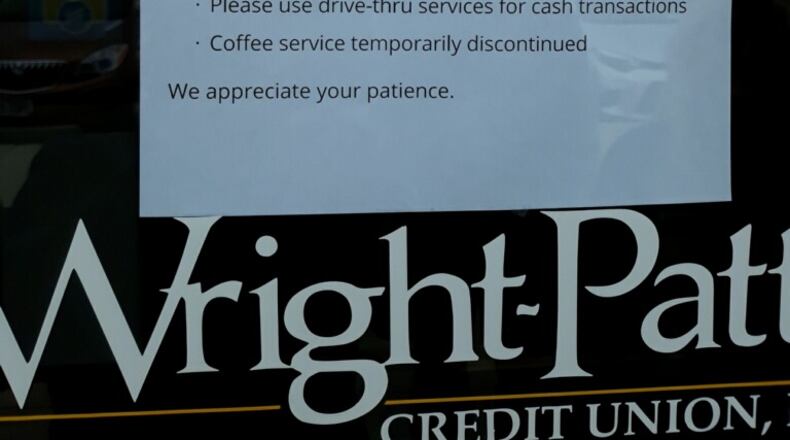

Wright-Patt Credit Union is also operating in a drive-through mode, closing lobbies for locations with drive-thrus. Locations that don't have drive-thru lanes are open with social distancing in place, with the exception of 6 lower volume locations that include Wright State University, Wright-Patterson Air Force Base and a number of branches in Columbus.

Wright-Patt Credit Union also said it will temporarily waive some fees, suspend new foreclosures and automobile repossessions, and offer temporary unemployment loans until Ohio’s state of emergency surrounding the Covid-19 pandemic is lifted.

“This is a difficult time for everyone, so we’re doing everything we can to protect the health and safety of our member-owners and partner-employees, while helping those who are experiencing the financial impact this has had in the communities we serve,” Doug Fecher, Wright-Patt Credit Union president and chief executive, said in a release.

Wright-Patt Credit Union said it will also temporarily let members skip up to three consumer loan payments without penalty. The credit union said it will also:

• Suspend new foreclosures and automobile repossessions

• Suspend late fees on loans

• Suspend non-sufficient funds fees

• Suspend share transfer fees for overdraft protection

River Valley Credit Union branches are operating as drive-through or by appointment only. Civista Bank is making similar changes.

At Fifth Third Bank, banking center lobbies will remain open to serve customers by appointment only and will not be open for general access.

Bankers will remain available and ready to help by phone, Fifth Third said. Customers who would like to meet with a banker in person can schedule an appointment on 53.com, the bank’s mobile app or by calling a local banking center.

For more information, Fifth Third is directing customers to 53.com/covid19

Fifth Third said it is also:

• Deferring vehicle payments for up to 90 days and no late fees during the deferral period. The bank is also suspending any new repossession actions on vehicles for the next 60 days.

• Deferring consumer credit card payments for up to three payments and no late fees during the deferral period.

• Mortgage and Home Equity Program: 90-day payment forbearance with no late fees.

• Small Business Payment Deferral Program: Payment deferral program for up to 90 days, with no late fees. The bank is waiving all fees on Fifth Third Fast Capital loans for six months.

Fifth Third is also suspending all foreclosure activity on homes for the next 60 days.

Fifth Third Bank Mart locations will remain open, but hours will change to 10 a.m. to 4 p.m. Monday through Saturday.

“Our banking centers are the face of our company for many customers,” Greg Carmichael, Fifth Third chairman, president and CEO said in a release. “That’s why we are committed to continuing to serve our customers at banking centers as best we can. While we have to temporarily adapt our banking experience to keep our customers and employees safe, we are working to ensure it remains as easy and convenient as possible to do business with us. We appreciate our customers’ understanding during these challenging times.”

Starting Thursday, KeyBank said all its branches will operate by drive-thru or in its lobbies by appointment only.

Clients may be eligible for a forbearance or extension, waived fees (late or overdraft) or waived penalties for early CD withdrawal. More information about those and other programs are available at Key.com/coronavirus.

About the Author