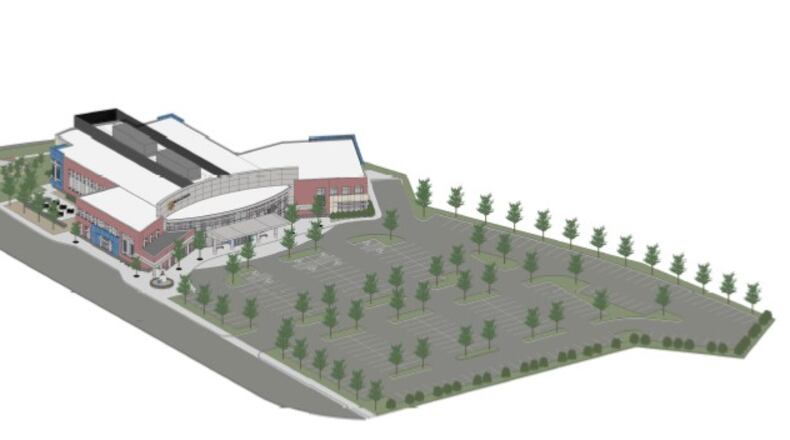

Most recently: With PNC Bank, CityWide allocated the credits to support the new health clinic being built by Dayton Children’s Hospital. That deal just closed late last week, said Brian Heitkamp, president of CityWide.

RELATED: Hospital starts work on $28M health center on Stanley

The credits have been used to boost development of the Third Street Dayton Recreation Complex, the YWCA women’s shelter, a Tech Town business park building, Goodwill, URS and other projects across the city, Heitkamp said.

In fact, CityWide is the only development organization in Dayton that can draw the credits from the U.S. Treasury, Heitkamp said.

Approved by Congress eight years ago, the credits are a tool to draw private investment to relatively low-income areas. The credits can be used to create low-interest, borrower-friendly loans, creating equity and new development all the while.

MORE: Dayton region sees strong manufacturing growth

CityWide applies to the U.S. government for the credits, which are sold to banks at a discount. Banks buy the credits at less than face value, lowering their tax burden.

CityWide or other community development entities then take that cash to find worthwhile projects, like Dayton Children’s.

One criterion, Heitkamp said: “Jobs that make an impact on the community.”

“CityWide finds impactful projects in low-income census tracts throughout the region,” he said. “We then allocate the credits to the selected projects. The investor buys the credits and inserts their investment into the projects.”

Each project is done separately so the investor and development organization mix can change, he said.

CityWide’s involvement in the Dayton Children’s clinic made sense, Heitkamp said. With that project, CityWide put about $8.5 million of the new market credits into the building while PNC invested about $2 million.

Late last year, the city of Dayton approved rezoning the former Dayton Electroplate property at the corner of Stanley Avenue and Valley Street to make way for the new clinic, to be built by Beavercreek-based Synergy & Mills Development.

CityWide isn’t the only organization helping with the project. Before construction began, the hospital asked the Dayton-Montgomery County Port Authority to take title on the property, hold it and then deed the site back to the hospital at the appropriate time, said Jerry Brunswick, executive director of the Port Authority.

“Really, it’s all about providing solutions to projects,” Heitkamp said in a recent interview. “Whether it’s a Port (Authority) product, our product, whoever — or just some consulting we do on the structure of a deal — really, our goal here is to move the projects forward.”

About the Author