MORE: JUST IN: Chris Kershner named to lead Dayton chamber

But bankers and industry observers have been warning for days that they have been swamped with loan applications, and the nearly $350 billion set aside for the program is going fast.

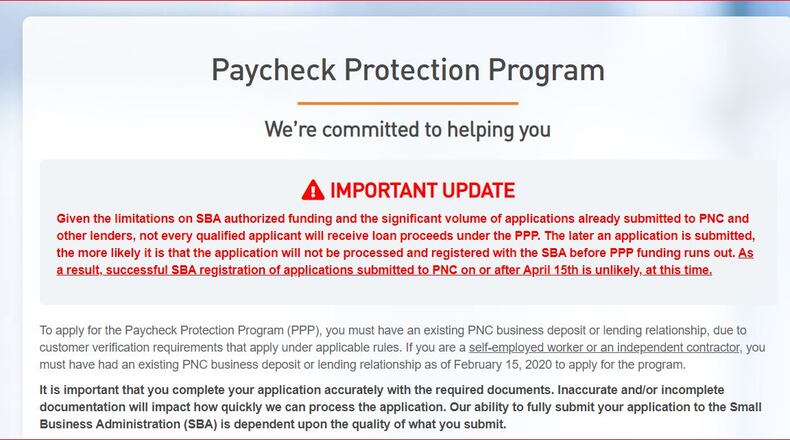

“The later an application is submitted, the more likely it is that the application will not be processed and registered with the SBA (Small Business Administration) before PPP funding runs out,” PNC Bank is telling visitors to its web site Wednesday.

RELATED: Ohio is in top 10 for Paycheck Protection loans

“As a result, successful SBA registration of applications submitted to PNC on or after April 15th is unlikely, at this time,” the message adds.

A message seeking comment was sent to a spokeswoman for PNC, who referred the message to a colleague.

A spokeswoman for the SBA could not immediately offer the latest PPP program numbers Wednesday, but by at least one report, just 15 percent of funds remain nationally.

As of Tuesday afternoon, the SBA had approved 38,106 loans to small businesses in Ohio, for a total of $10,368,882,724 in Paycheck Protection loans.

That left Ohio ranked about 6th in the nation for loans approved, according to SBA documents obtained by the Dayton Daily News Tuesday.

Total loans approved nationwide amount to nearly $248 billion so far, the documents indicated Tuesday, for just over 1,035,000 loans approved nationally.

Some businesses have said PPP loan requirements are over-restrictive while banking officials have said that the SBA portal for the program has been hampered by technical glitches, slowing the application process.

About the Author