“From at least 2003 through 2017, Schmidt betrayed his customers’ trust by perpetrating a classic fraudulent scheme: he robbed Peter to pay Paul,” the SEC said in its complaint, filed last week in federal court.

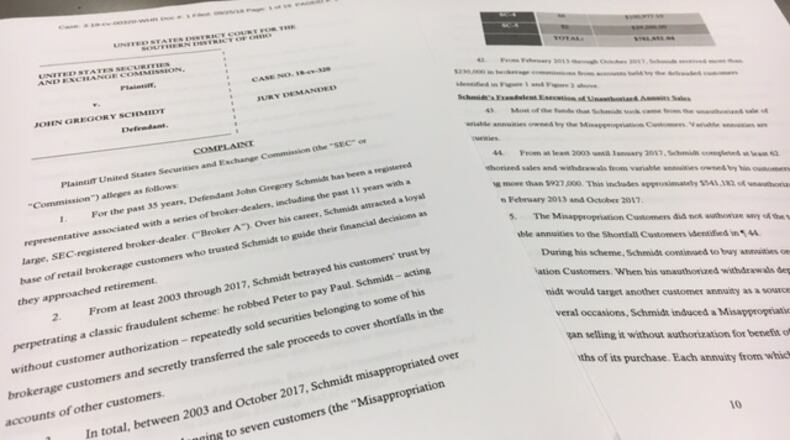

In a civil filing seeking a jury trial, the commission charges that Schmidt sold the securities of some of his customers and secretly transferred more than $1 million in proceeds to 10 other customers to cover shortfalls in their accounts.

The SEC says Schmidt, 67, a Bellbrook resident, attempted to cover unauthorized sales and withdrawals from variable annuities held by customers, “secretly transferring funds using fraudulent letters of authorization, and issuing fake account statements.”

MORE: REIT buys Miami Twp. land for $6.9M

An SEC complaint states: “Schmidt concealed the shortfalls from his customers and repeatedly lied to them about the true state of their investments.”

“Most of the injured customers were elderly with little to no financial expertise and were particularly vulnerable,” the SEC said in a release on the charges. “Schmidt received over $230,000 in brokerage commissions from these customers.”

Added the SEC in a court complaint separate from the release: “At least five of Schmidt’s victims passed away during the course of his fraud.”

Several of his victims suffered from Alzheimer’s disease or other forms of dementia, the SEC said.

A phone message seeking comment was left Tuesday for Schmidt. Messages were also sent to SEC trial counsel and a spokesman for the Montgomery County prosecutor’s office.

MORE: Ready for the ride of your life — at 760 mph?

In its release, the SEC said the investigation is continuing.

“The protection of senior investors, who may not be in a position to carefully monitor their investments, is a critical part of the SEC’s mission,” Joel Levin, regional director of the SEC’s Chicago office, said in a statement. “When investment professionals violate the trust that senior investors place in them, we must ensure that they are held accountable for their misconduct.”

The complaint was filed in federal district court in the Southern District of Ohio. The SEC is seeking a judgment ordering Schmidt “to disgorge his ill-gotten gains with prejudgment interest, and to pay civil penalties.”

The SEC said Schmidt worked in Dayton with a “large nationwide broker-dealer and investment advisor.” The broker fired Schmidt in October 2017 based on conduct described in the SEC complaint, the SEC said.

According to Schmidt’s employment history found on brokercheck.org, a Financial Industry Regulatory Authority web site, Schmidt was employed by Wells Fargo Advisors Financial LLC from 2006 to 2017 and by Stifel, Nicolaus & Co. Inc. from 2002 to 2006, the years in question.

By the time he was fired, Schmidt had about 325 retail brokerage customers, at least half of whom had been relying on him for more than a decade, according to the government.

The SEC complaint does not directly name any of Schmidt’s customers in its filing, referring in some as “shortfall customers” or “misappropriation customers” or “customer X.”

Various customers are referred to in the complaint as “SC (shortfall customer)-1” or “SC-2.”

Schmidt lied to “shortfall customers,” telling them they held securities they didn’t own and that their account balances were higher than they actually were, according to the SEC.

But the ruse eventually was discovered, the government said. When “shortfall customers” withdrawals eventually overdrew their depleted accounts, Schmidt would sell securities in the accounts of “misappropriation customers” without authorization, transferring proceeds to the accounts of the original “shortfall customers,” the SEC said.

“Schmidt’s scheme was profitable,” the SEC said. “From Feb. 2013 through Oct. 2017, Schmidt received over $230,000 in commissions from customers who were either the source of, or recipient of, misappropriated funds.”

The scheme began to unravel in the summer of 2017, when Schmidt was asked to respond to an inquiry by the Ohio Department of Insurance, according to the commission’s account.

Even after he learned of a state investigation, the SEC wrote, “Schmidt tried to ensnare a new victim.”

In a March 2018 interview, Schmidt refused to answer SEC questions and invoked his right against self-incrimination under the Fifth Amendment to the U.S. Constitution.

About the Author