>>>RELATED: ‘Please give families a break’; Respondents ask Ohio Medicaid for changes to estate recovery

Public comments submitted to Ohio Medicaid, obtained by the Dayton Daily News, show some residents want changes to how the hardship waiver system works, among other reforms. This includes one person — names were redacted from public comments — who wrote that their mother died in 2019 and they are still awaiting a determination on a hardship waiver. The commenter wrote that they are on public assistance, while the state has a lien on their mother’s house.

“It has been four years almost,” the commenter wrote. “In that time her house has been falling into to disrepair. Holes in the roof have now caused holes in the floor. People have broken in and stolen all the copper pipes, wires and damaged the plumbing, heating and electrical systems. So no roof, no heat, no electricity and no water, because of a lien where my mom had breast lymph cancer.”

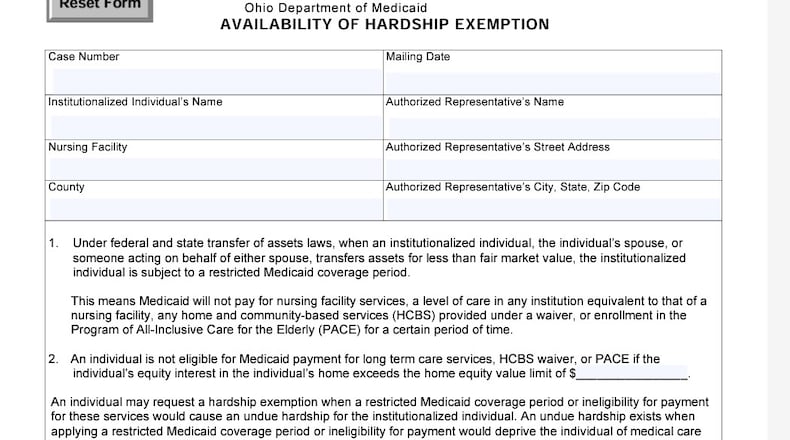

Ohio provides undue hardship waivers for surviving family members who may be impacted by the estate recovery process. Applications are due within 30 calendar days of after notice of the estate recovery claim was mailed by the attorney general’s office, according to the Ohio administrative code.

Another public comment submitted to Ohio Medicaid suggested removing that time limit.

If the attorney general’s office is seeking repayment through placing a lien on the beneficiary’s home after their death, hardship waivers provide certain exemptions for people still living there. Those include spouses, children under 21 years of age, and disabled children of any age living in the home.

Siblings of the beneficiary can also seek a hardship waiver if they can show they have lived in the home at least one year immediately before the Medicaid beneficiary moved permanently into an institution, according to the Ohio administrative code.

Adult children who are not disabled can also seek a hardship waiver if they can show they provided care to the permanently institutionalized individual that delayed the individual’s institutionalization. They also have to have resided in the home for at least two years immediately before the date of the individual’s admission to the institution.

If the home or property with the lien is the sole income-producing asset of the survivor, such as a family farm or other family business, Ohio Medicaid can also take that into consideration.

Additional reasons can qualify an heir or potential heir for an undo hardship waiver, but those waivers are provided at the discretion of the Ohio Medicaid director or the director’s designee.

This case-by-case determination creates an administrative burden and additional costs for the state, providing additional reasons as to why estate recovery may not be worth it, advocates say.

“For the amount of administrative burden and the amount of resources that the Medicaid agency goes through to recoup and then who is harmed by that recoupment, no, I don’t think it’s worth it. Quite the opposite,” said Amber Christ, managing director of health at Justice in Aging.

Ohio does not take the value of the home into consideration when providing exceptions under a hardship application from the people in charge of the estate after the Medicaid beneficiary has died. Only eight states take into consideration if the home is of modest value, according to the Medicaid and CHIP Payment and Access Commission (MACPAC), a group that advises Congress. Ohio does not perform any other cost-effectiveness test, according to MACPAC.

Public commenters asked the state to consider making that change. One commenter suggested establishing a threshold of $50,000 to keep up with inflation.

“Thus, any estate below the $50,000 limit will be released back to their families,” the commenter said.

The commenter whose mother died in 2019 wrote that her mother’s home is valued at $55,000; under current rules, estate recovery is benefitting no one.

“The state of Ohio will potentially have a home that will not even be able to sell,” they wrote. “It will have to be torn down and use additional public resources and funds.”

About the Author