$2,000 before losing eligibility for critical means-tested benefits like Medicaid or Supplemental Security Income (SSI).

In 2016, Ohio launched STABLE Account, the nation’s first ABLE program. Through this program, people have access to specialized savings and investment accounts that allow them to take better control of their financial future while also preserving access to those very important means-tested benefits. These accounts have proven to be a “gamechanger” for accountholders and their families, helping them to better manage a multitude of disability-related costs.

Earnings on a STABLE account grow tax-free and are not subject to federal income tax, so long as they are spent on Qualified Disability Expenses such as education, housing, transportation, healthcare, assistive technology, basic living expenses, and more.

In the State of Ohio, we’ve seen first-hand how accountholders are enjoying an enhanced level of financial independence and security. We’re proud to share that since 2019, the Treasurer’s office has more than tripled STABLE Account enrollment, and the program continues to grow in popularity. Today, the program serves more than 43,000 accountholders, giving these participants and their families a renewed peace of mind.

STABLE Account contribution limits are adjusted annually, and accountholders can currently contribute up to $18,000 for the year.

An important component of existing ABLE law allows employed participants to save beyond the $18,000 annual limit. The ABLE to Work provision enables individuals who are employed to contribute up to an additional $14,580 annually, increasing the total amount they can save and invest each year. As you can imagine, this creates an entirely new level of empowerment for a segment of accountholders as it provides them the freedom to remain in the workforce – enhancing their lives and adding yet another layer of independence.

But the ABLE to Work provision is set to expire at the end of 2025. Failure to renew this very important and life-changing component of the law would be detrimental to individuals with disabilities who are thriving in the workplace. Removing the ability for hard-working Americans to earn and save additional money would certainly be a step backward, as it would weaken the great progress that’s been made in the decade since the ABLE Act’s passage.

Thankfully, the Ensuring Nationwide Access to a Better Life Experience Act – or “ENABLE Act” – was introduced in the United States Congress earlier this year. This commonsense, bipartisan legislation would make ABLE to Work and other provisions permanent components of the STABLE Account program and other similar ABLE programs nationwide.

With October serving as National Disability Employment Awareness Month, it’s the perfect time to call attention to this critically important legislation and the life-changing benefits and security it would preserve for so many among us.

As of this writing, the ENABLE Act has passed in the Senate and a companion piece of legislation has been introduced and remains pending before the House and awaiting action.

STABLE/ABLE accountholders have grown accustomed to living independently and planning for the future, so the sooner this measure is passed, the sooner accountholders and their families will be able to rest easy. Innovative tools like ABLE to Work help us to foster a more diverse workforce and create new opportunities for so many who previously had felt left behind for far too long.

Here in Ohio, STABLE accounts have empowered thousands of lives and opened a series of new doors for so many families. We must ensure these powerful financial tools remain in place so thousands of more individuals can go on to unlock their fullest potential.

The United States Congress must pass the ENABLE Act to ensure the permanent protection of the life-changing benefits of ABLE accounts for the millions of deserving Americans living with disabilities.

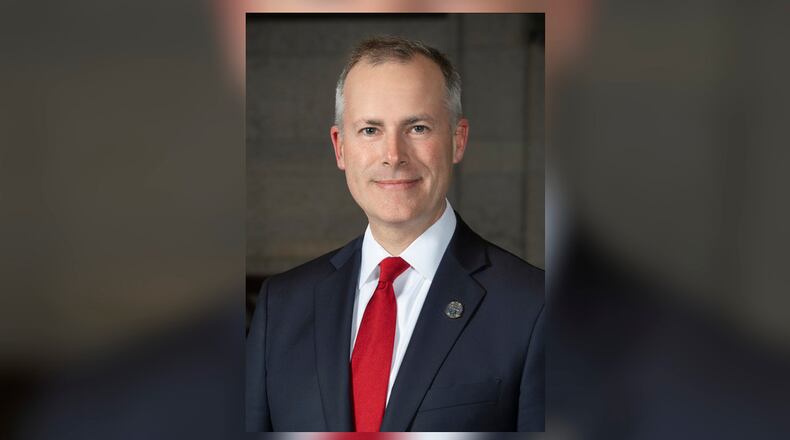

Robert Sprague became Ohio’s 49th Treasurer of State on January 14, 2019, bringing to the office his extensive experience working on financial matters in both the public and private sectors. Under Treasurer Sprague’s direction, the office manages the state’s $39 billion investment and $11 billion debt portfolios, collects and deposits all state revenues, and oversees custodial assets.

About the Author