My parents, George Moore Sr. and Ruth Moore, were educators, and they too prioritized the education of their children and grandchildren by saving a portion of their paychecks for this purpose. My father worked as a brick mason and a tax assessor on the side to bring in extra income. They also had a garden that supplied food for the household and the neighborhood. My mother did not actively work to earn extra income due to the expectations of her generation.

Shortly after my daughters were born, I began setting aside at least $100 a month for their education and invested in a 529 college savings plan with growth funds. In the interim, we ate home-cooked meals vs. dining out, took lunch to work, and drove used cars to save money.

Unlike many conventional wealth-building methods that focus on extreme frugality and constant sacrifice, I like to emphasize the value of self-care and the importance of enjoying life while making the journey toward financial independence. The stressors of building wealth should not come at the expense of one’s happiness or well-being. Travel, exercise, pray and more!

I wrote my book Financial Freedom: Doing Nothing Is An Option to empower other families to do the same. I wanted to also challenge the dominant narrative around wealth-building and help people redefine what it means to achieve financial freedom.

Mostly, financial freedom is not about having to constantly hustle, cut corners or sacrifice. It’s about creating a sustainable lifestyle that allows you to live according to your values and priorities, referred to by Mehrsa Baradaran book The Color of Money Black Banks And The Racial Wealth Gap for barriers that we still face.

I achieve financial freedom by simply letting my money work for me. I believe in the importance of creating multiple streams of passive income (rentals, royalties) and investing wisely (equities or stocks, mutual funds, ETFs) while also enjoying the present moment and finding balance in life.

Here are some tips:

1. Track your spending and create a budget plan that details monthly income, expenses, and savings goals to include an adequate emergency fund.

2. Identify means to earn additional income or reduce spending to meet your budget goals.

3. Develop a savings plan where you set aside a portion of your income each month towards short-term and long-term financial goals.

4. Use financial professionals and or online budgeting tools or apps to help you stay on track, monitor your progress and educate your family.

5. Trust the Lord and have fun along the way, as you only have one life to live.

Remember, achieving financial freedom is a long-term goal that requires patience, discipline, and consistent effort. Keep good records and pay your taxes. Different strategies are required at different levels. And an emergency fund ensures that you enjoy a more comfortable journey.

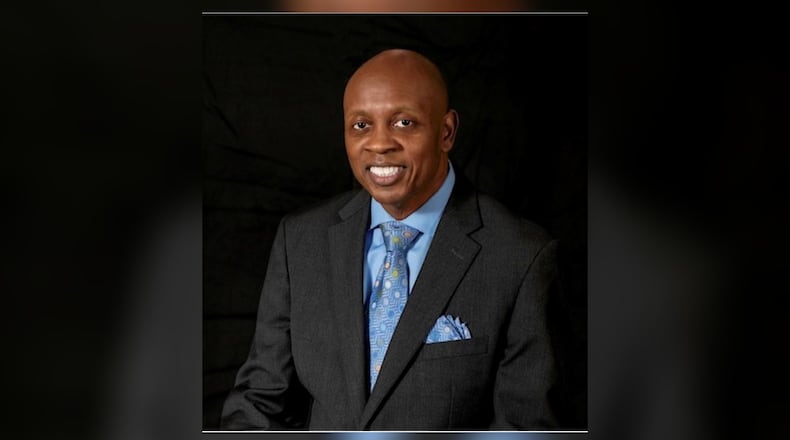

Dr. Edmund H. Moore is a resident of Dayton, Ohio and works as an engineer for the federal government. He is actively involved in his community through his church and Parity Inc. In his leisure time, he enjoys reading, playing golf and providing assistance to others. Dr. Moore also loves spending time with his daughters.

About the Author