The company pushing for the tariffs, Cleveland-Cliffs, is a major miner and also the nation’s largest flat-rolled steel producer. In March, the U.S. International Trade Commission agreed to consider imposing tariffs of up to 300% on imported “tinplated” steel — the metal used in everything from our higher-end canisters to canned soups and vegetables to paint buckets — at Cleveland-Cliffs’ request. The company alleges that manufacturers in eight countries — Canada, China, Germany, the Netherlands, South Korea, Taiwan, Turkey, and the United Kingdom — are engaging in unfair trade practices by flooding the United States with low-cost tinplate. It hopes the tariffs will force companies like mine to buy their steel.

As an American steel-can manufacturer, I’d love nothing more than to buy domestic tinplate. But for us, that isn’t an option.

U.S. tinplate steel manufacturers make very little of the higher-quality, specialized steel we need. Because domestic steel companies find it difficult to meet our specifications, we have no choice but to rely on foreign steel suppliers. So, if these tariffs go into effect, our input costs could surge by as much as 300%.

It’s not just my family business that faces ruin. Evidence shows that tariffs are ultimately paid by American consumers, not foreign manufacturers.

Consider how the same agency considering these new tariffs, the USITC, recently published a report that found American companies paid almost the entire cost of the tariffs that the Trump administration imposed on $50 billion of Chinese imported steel and aluminum. In effect, a 300% tariff on tinplate steel is a 300% sales tax on the key raw material in nearly every canned good.

A simple look at the numbers suggests the tariffs will destroy more American jobs than they create. One analysis projects that if applied to their full extent, the tariffs would boost steel manufacturing employment by 66 jobs — but endanger roughly 40,000 other manufacturing positions. In other words, the taxes could destroy 600 jobs for every new worker employed in steel making.

The companies that use tinplate steel will have no choice but to pass these taxes on to the end consumer.

This summer, the Department of Commerce issued a preliminary decision on the tariffs which rejected the absurdly-high duties proposed by Cleveland-Cliffs. It was a tentative win for domestic businesses like mine — but our future hangs in the balance until a final decision is released early next year.

I’m not an economist or a diplomat. I’m just a small business owner trying to do right by his employees and customers. That’s why I’m speaking out — because if the Biden administration moves forward with these tariffs, it’ll help a few well-connected steel bigwigs at the expense of my friends, family, and tens of thousands of other American manufacturing workers.

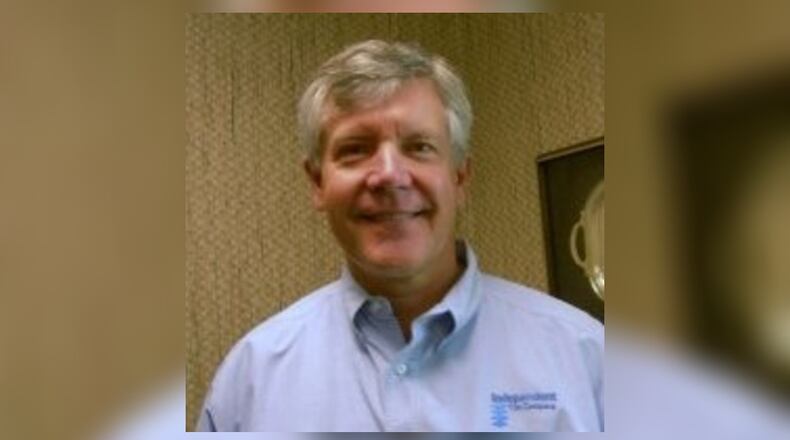

Rick Huether is the President and CEO of the Independent Can Company. This piece originally ran in RealClearPolicy.

About the Author