That’s the same cost as the levy voters rejected in March and less than the 5.9-mill combined operating/permanent improvement levy they rejected in November 2023, which would have cost property owners $206.50 a year per $100,000 of home value as determined by the county auditor.

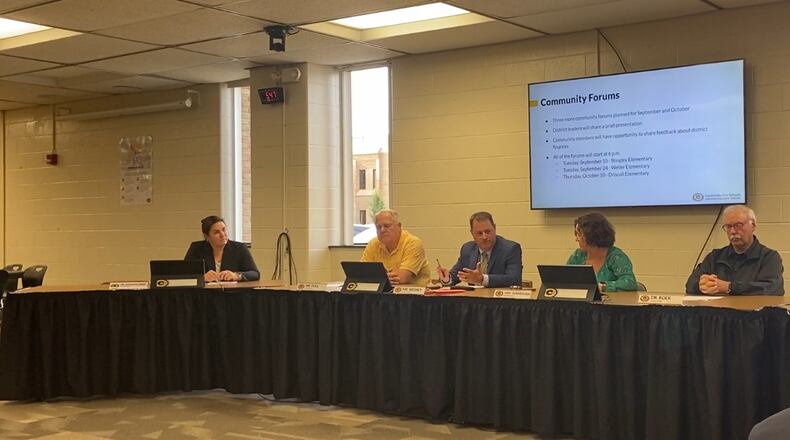

Centerville Superintendent Jon Wesney said the proposed levy would help the district continue supporting its students with comprehensive programs, carry out its strategic plan, and manage rising day-to-day costs.

“Due to how schools are funded in Ohio, the need for additional funding doesn’t go away, even after the $3.5 million in budget reductions we made for the 2024-25 school year,” he said. “Centerville Schools receives relatively flat funding from the state and from voted levies each year, so as costs go up, we must either ask our community for more support or make tough decisions about cutting educational programs.”

Centerville/Washington Twp. voters last approved a levy for additional funding for the school district in November 2019. They renewed an existing emergency levy in 2022, one that did not increase taxes or revenue and a levy that must be renewed every 10 years.

Voters rejected new tax levies in November 2023 and March 2024. That led to a Centerville Schools reduction plan that shaved about $3.5 million from the district’s operating fund, by cutting teaching and support staff positions and increasing fees and building/athletic field rental costs.

A proposed reduction plan was approved by the school board in September and would be implemented if the November levy fails.

“We already run a lean operation, as evidenced by our above average student-to-teacher and student-to-administrator ratios,” Wesney said. “We have 48 less staff members in our buildings than we did in the fall of 2023, and since 2019 we have cut a total of 65 full-time positions. This means more work falls on the employees that are left and impacts class sizes, student academic and health and wellness supports, implementation of our strategic plan goals and more.”

Centerville City Schools Board of Education President Allison Durnbaugh said that with the way Ohio funds school districts, the only option for Centerville and other districts is to go back to the community to ask for additional funding.

“It’s not a matter of we can’t live within our means, it’s (a matter of) all of our costs are going up,” Durnbaugh said.

Asking for further cuts would adversely affect the quality of education and diminish the district’s attractiveness to new residents, she said. That, in turn, could potentially not attract quality employees for the district because of an inability to get a levy approved and the schools appropriately funded, she said.

“It’s kind of a snowball effect,” she said. “All of those things are tied together.”

Waiting until 2025 to approve a levy would mean not being able to begin collection until calendar year 2026, Wesney said.

“The longer the district waits to increase its tax revenue, the larger the deficit spending will be,” he said. “The district may need to ask for a larger millage amount to make up that difference by waiting until 2025 to be on the ballot. A lower millage now makes it less costly for taxpayers in the long run.”

Centerville, as part of its community engagement efforts regarding the levy, will be holding another informal opportunity to talk with Wesney and other members of the district leadership team at 5:30 p.m. Oct. 29 at Forest Field Park Shelter, 2100 E. Centerville Station Road.

Support, opposition

“I am hopeful that folks see that this is the third and kind of most dire effort for us to ensure the quality of our schools,” said Chelsea Stinnett, a Centerville parent with two children, ages six and three. “Both of my children are really young and I think about what the long-term effects of their opportunities within the district will be, if this doesn’t pass, given the delay it will mean for us to receive some pretty critical funding.”

Stinnett, a trustee with nonprofit Centerville Education Foundation and an educational researcher with University of Massachusetts Boston, said that from a homeowner’s perspective, she doesn’t want to see the value of her home plummet.

Tim Cook, of Washington Twp., said he opposes the levy, but is not against the school system.

“It’s important and expensive, but current spending is unsustainable without an income tax,” Cook said. “The district will spend almost $650 million over the next five years and the so-called levy cycle of unconstrained deficit spending has become a normal course of business.”

About the Author