Kettering plans to offer 75% annual property tax exemptions in increments of 10, 12 and up to 15 years, city records show.

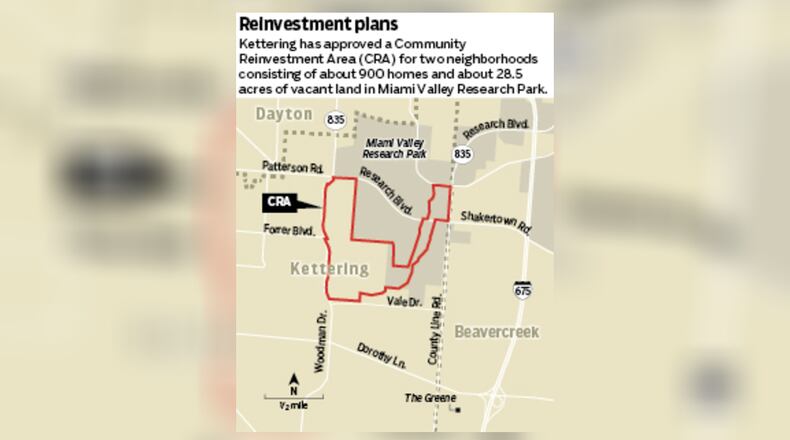

The area is generally bordered by Woodman Drive, Research Boulevard, County Line Road and State Farm Park, and Aragon Avenue, city Economic Development Manager Amy Schrimpf said.

It includes “several properties with blighting influences” in neighborhoods conceived during World War II that have lacked significant reinvestment, according to a state-required housing study.

The zone also includes undeveloped, corner acreage near the Beavercreek corporation line at research park — home to more than 4,000 jobs — that Kettering has agreed to sell to a developer to build more housing, Schrimpf said.

“Essentially,” City Manager Matt Greeson said, “what we’re trying to do here is create a tool … to help residents in those two neighborhoods improve their properties” while “creating a tool where we can incentivize high-quality, market-rate apartments” at Research and County Line.

Cleveland-based Industrial Commercial Properties, which owns about 50 acres at MVRP, has expressed strong interest in building a 300-unit apartment complex at that intersection.

After talks with ICP, Kettering expanded uses on certain research park land to allow housing and restaurants.

While still requiring county and state approval, Schrimpf said she expects the city’s vote this week to create the new zone, called a Community Reinvestment Area, will prompt ICP to soon submit plans.

Attempts to reach ICP representatives were unsuccessful.

Questions about vote

Before city council’s vote 5-0 Tuesday night, the lack of public debate on the issue was questioned by one resident.

“I don’t know whether this (CRA) is a good thing or a bad thing,” Sterling Abernathy told council. “Before the CRA is approved, you should proactively inform the public and the 900 property owners” to allow an “opportunity to ask questions and listen to their feedback.”

Abernathy called the designation “a negative label,” and raised questions about how it could adversely impact property values and the marketability on homes in the zone.

Schrimpf said the move will not hurt the neighborhood, but instead provide financial incentives “for property owners who renovate or remodel” and improve property values.

“We’re kind of giving that neighborhood special status in the city,” she said.

CRAs “are areas of land in which property owners can receive tax incentives for investing in real property improvements,” according to the Ohio Department of Development.

One aim of the program is “to encourage revitalization of the existing housing stock and the development of new structures,” according to the state.

Tax break details

Kettering’s zone, called the Aragon Oak Park CRA, will provide tax exemptions in the following ways, according to city records:

•10-year, 75% exemptions for structures containing no more than two homes — at least one of which is owner occupied — for remodeling projects ranging from $15,000 to $20,000 for each unit.

•12-year, 75% breaks for dwellings containing at least two homes for remodeling projects exceeding $20,001 for each unit.

•Up to 15-year, 75% exemptions for structures containing at least three homes for which the investment for all buildings is at least $30 million.

The state requires a housing study to establish the zone, Schrimpf said. Much of the area was platted in 1942 with most of its homes built in 1945, according to the study.

“Due to the age and inefficiency of many of the homes … reinvestment has been sparse,” it states.

The median sale price for homes in that area two years ago was about $36,000 less than Kettering’s city-wide figure of $165,050, according to the study.

Pending county and state approval, the city will be notifying property owners in that area about the program’s details, officials said.

Kettering will create a council to review applications and designate a housing officer to make annual inspections of properties receiving exemptions, city records show.

About the Author