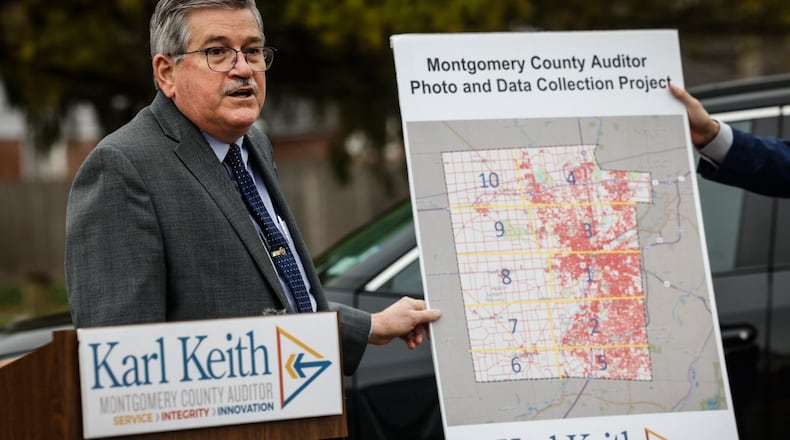

He said that the county has contracted with Vision Government Solutions, which will use vehicles equipped with timed cameras to take automatic pictures as they drive the county’s roads. Those photos will be combined with aerial photography and the auditor’s office property database to help appraisers determine each property’s value, Keith said.

Credit: Jim Noelker

Credit: Jim Noelker

Vehicles will have decals identifying them as part of the county’s photo and data collection project, and drivers will carry official county ID badges, he said.

The first phase of photo collection will take place in Dayton, Oakwood, Moraine, Riverside and northern Kettering in November and December. Officials expect the photographing process to be complete by the end of Spring in 2025.

Revaluation timeline:

- Now through late spring 2025: Contractors take images of property

- All of 2025: Montgomery Auditor’s Office gathers sales data

- By spring 2026: Auditor’s office reviews images/sales info and makes preliminary value decisions, then sends them to Ohio Department of Taxation

- Summer 2026: After tentative approval, auditor’s office notifies property owners of new property values

- Summer 2026: Informal review process begins to address property owner concerns

- End of 2026: New, finalized property values submitted to department of taxation

- January 2027: New property tax bills sent out

Property evaluation happens in a cycle every three years, Keith said, and is a lengthy project.

“It’s a big job,” he said, adding that they want to do it as thoroughly as possible. He said that there are more than 250,000 real estate parcels in the county spread over 3,600 miles of roads.

Speaking about where he expects the new property values will be, Keith said it was too early to tell. He did say that real estate values in neighboring counties had risen, pointing to Warren County, which saw residential values rise an average of 27%.

“The post-COVID housing boom continues throughout the state,” he said. He later added that sales have calmed slightly from the last valuation but said that the housing market is still showing strong sales.

When asked why he thought prices were rising, Keith said that people in the industry would say it was a lack of housing supply in the market, and low interest rates are attractive to buyers.

About the Author