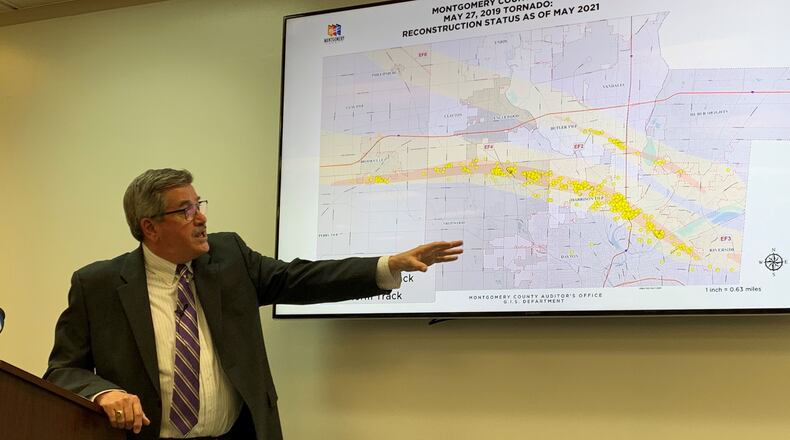

“While we recognize and celebrate the progress that has been made, we know that there is more work to be done and we still have a long way to go,” Keith said. “We don’t want to lose sight of that — 31% of damaged properties remain in need of repair and reconstruction.”

The auditor’s office’s assessment is based on visits to properties between October 2020 and May 19, 2021. It will impact what property owners will pay on their taxes in 2022.

Trotwood suffered the largest property value loss: roughly $30 million. Of 817 parcels impacted, roughly 67% have been reconstructed, leaving the tax rolls down $5.4 million, according to the auditor’s office report.

Trotwood Mayor Mary McDonald said she is hopeful about the city’s recovery.

“Many of our citizens have been able to regain their sense of place in the community and we are happy about that,” she said. “I think our future is very bright and I’m very hopeful that many of our citizens are trying to get back into the city of Trotwood.”

One long-term loss McDonald lamented is how the loss of trees changed the character of some neighborhoods. Keith said this wasn’t part of his office’s analysis, but it can affect sale prices, which would ultimately impact tax values.

Perry Twp., Brookville, Vandalia and Butler Twp. meanwhile have seen a combined $4.6 million property value increase at tornado-impacted properties because of the value of the property improvements, according to the auditor’s office.

The auditor’s office numbers only include properties damaged enough to impact their property values. The Miami Valley Regional Planning Commission also tracks rebuilding. MVRPC currently reports that of 4,431 Montgomery County properties damaged in the storm, 190 are in the process of rebuilding and 103 are untouched. They don’t have data on 784 properties.

An analysis for the Dayton Daily News by Greene County Auditor David Graham found that, of the 88 properties that had their taxable value decreased in 2019 after the tornado, 51 increased again in tax year 2020.

The regional planning commission data says 1,182 Greene County properties were damaged by the storm. They have no data on seven of them, but they have 28 listed as in progress of being repaired and rebuilt and none that show no progress.

Laura Mercer, executive director of the Miami Valley Long Term Recovery Operations Group, said for some people recovery is slowed by ongoing fights with insurance and contractors. Also, the price of building materials has skyrocketed.

“We’re finding some people who were just so overwhelmed by the process that they haven’t done anything except re-tarp their properties,” she said. “At this point some of them are just deciding they are going to short sale their houses.”

The recovery operations group will be dissolved in October. They recently sent notices to owners of single families homes that showed no progress saying if people want help, they need to apply now. They are now working on similar notices for people whose rebuilding is in process.

“Anybody who needs help, we want them to ask for it.” she said.

| Lasting Montgomery County tornado damage | |||||||

|---|---|---|---|---|---|---|---|

| Of the thousands of Montgomery County properties that lost value because of damage from the Memorial Day 2019 tornadoes, roughly 69 percent have been repaired and regained value in the two years since, leaving the tax base more than $8 million smaller today. | |||||||

| Jurisdiction | Damaged Parcels | Repaired Parcels | % Repaired | Property value loss | Value regained from repairs | Value of tornado repairs in 2021 | Net difference |

| Trotwood | 817 | 551 | 67% | -$29,937,000 | $24,508,000 | $14,364,000 | -$5,429,000 |

| Harrison Twp. | 898 | 612 | 68% | -$23,028,000 | $20,134,000 | $13,984,000 | -$2,894,000 |

| Dayton | 480 | 331 | 69% | -$14,955,000 | $13,302,000 | $9,322,000 | -$1,653,000 |

| Perry Twp. | 188 | 158 | 84% | -$5,887,000 | $7,597,000 | $3,996,000 | $1,710,000 |

| Brookville | 157 | 131 | 83% | -$4,786,000 | $5,984,000 | $2,802,000 | $1,198,000 |

| Vandalia | 27 | 18 | 67% | -$3,051,000 | $4,442,000 | $3,965,000 | $1,391,000 |

| Butler Twp. | 114 | 81 | 71% | -$2,965,000 | $3,298,000 | $2,036,000 | $333,000 |

| Clayton | 48 | 30 | 63% | -$2,597,000 | $1,795,000 | $1,080,000 | -$802,000 |

| Riverside | 31 | 26 | 84% | -$1,329,000 | $469,000 | $314,000 | -$860,000 |

| Englewood | 24 | 21 | 88% | -$905,000 | $872,000 | $596,000 | -$33,000 |

| Clay Twp. | 6 | 2 | 33% | -$234,000 | $44,000 | $44,000 | -$190,000 |

| TOTAL | 2640 | 1834 | 69% | -$84,968,000 | $76,525,000 | $49,731,000 | -$8,443,000 |

| Note: Jurisdictions on this sheet overlap | |||||||

| Source: Montgomery County Auditor's Office |

About the Author