But what are quitclaim deeds, and how is property stolen through these documents?

Here’s what you should know:

Quitclaim deeds

Deeds are documents that show ownership. These documents contain a description of the property, the names of the buyer and seller and the signature of the seller, and they must be notarized and filed with a county auditor’s office and recorder’s office to record the transfer of property.

Quitclaim deeds transfer property from one entity to another without a sale taking place. Quitclaim deeds are typically used by relatives or spouses to transfer property for this reason.

Oftentimes, no money is involved in the transaction, no title search is done to verify ownership of the property and no title insurance is issued. But quitclaim deeds, too, need to be notarized by an active, legitimate notary and filed with county offices to log the transfer of property.

How fraud occurs

In quitclaim deed property schemes, fraudulent signatures are made on the document, transferring the property away from the land or building’s owners.

From there, a fraudster can bring the document to a negligent or even complicit notary for the official stamp and signature needed for the deed to be processed by county offices that deal with property transfers.

Notaries are commissioned through their state and must apply for the duty, go through a background check, take a three-hour class and pass an exam, and upload a copy of their signature to the Ohio Secretary of State’s notary database before receiving their certificate and stamp. Non-attorney notaries’ terms expire after five years but can be renewed.

In some fraud cases, schemers allegedly affix a notary’s signature and stamp to the document themselves.

The fraudulent documents are then taken to the auditor’s and recorder’s offices to log the property transfer. After the property is officially transferred, the fraudulent owner may sell it to another unsuspecting buyer or even rent it out to tenants who have no knowledge of the fraud.

At-risk properties

Deed fraud can happen with any property, but some are at a higher risk than others in Montgomery County.

Properties that are typically targeted appear to be vacant and are often owned by people who do not live locally and are unable to check on their properties regularly, according to the Montgomery County Recorder’s Office.

Properties that are going up for rent or sale can also be at risk. Perpetrators of deed fraud often look at websites where people can search property sales, like Trulia.

I think I fell victim. What next?

If someone believes they are the victim of a scam, they are encouraged to contact their local law enforcement authorities.

The Montgomery County Auditor’s Office oversees the transfer of property, and the Montgomery County Recorder’s Office oversees the maintenance and storage of records. Both offices should be contacted regarding any concerns related to quitclaim deed fraud. The recorder’s office is forwarding suspected cases of fraud to the Montgomery County Prosecutor’s Office for review, too.

The recorder’s office can be reached at 937-225-4275, auditor’s office can be reached at 937-225-4326.

For people who want to challenge their property’s ownership in a civil case, the Greater Dayton Volunteer Lawyers Project could provide legal assistance.

Protecting your property

Property owners can take multiple steps to protect their homes from quitclaim deed fraud.

Residents whose primary residence is outside of Montgomery County are advised to have local relatives or trusted friends check on their Dayton-area properties regularly, according to the Montgomery County Recorder’s Office.

Safeguards for hopeful homebuyers, too, include performing a title search on a property before completing a sale and checking property records through the Montgomery County Auditor’s Office to confirm details about ownership.

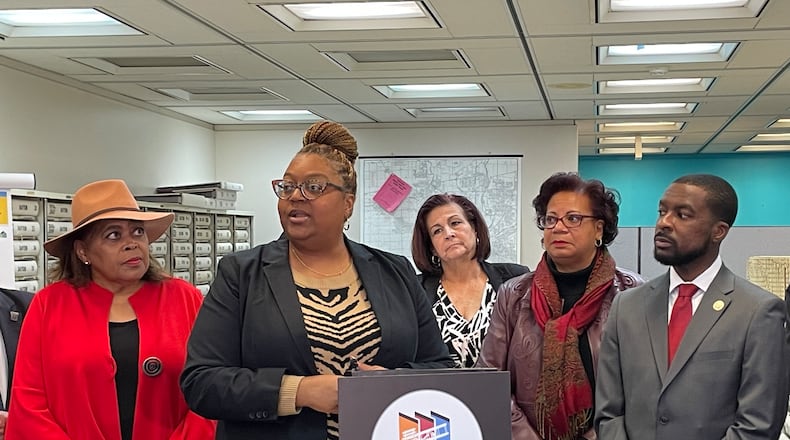

Local leaders urge Montgomery County residents to sign up for The Fraud Alert Notification System (FANS) to receive an email, a letter or both whenever a deed, a mortgage or a lien is filed on parcels enrolled in the service. Residents can enroll on the county recorder’s website or at its office.

About the Author