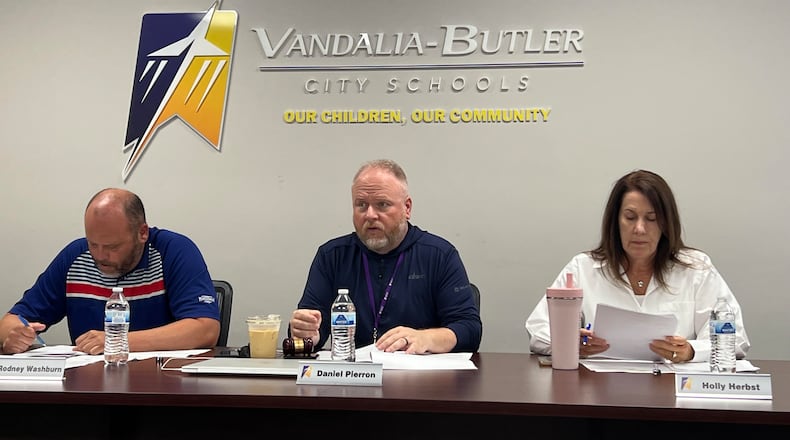

The approval of these resolutions will allow the district to obtain tax rate and millage estimates from the Ohio Department of Taxation, board member Daniel Pierron said Thursday.

Two of the tax levy options listed are property taxes and the other two are earned income taxes. The options are being considered for placement on the Nov. 7, 2023, election ballot.

The first proposed property tax levy would be an additional tax to raise $4.2 million per year for a five-year period. The second property tax option would levy an additional tax in the amount of $4.56 million per year over the same five-year period.

The first proposed earned income tax levy (0.5%) would raise an additional $3.45 million annually, and the second option (0.75%) would amount to an estimated $5.22 million per year.

Butler Twp. resident David Chewning addressed the school board during Thursday’s special meeting to express his concern about the types of tax levies being considered.

“I know it was discussed in at least one other meeting that a lot of folks felt like the earned income tax was a little bit unfair,” Chewning said. “To me, with the earned income tax, you’re limiting who’s going to be paying this, and limiting the scope of what is going to be taxed.”

Board member Rodney Washburn noted that the board is considering a property tax option, as well.

“That’s one reason that the property tax option is on there; so, it would do the trickle down, or trickle up, effect,” Washburn said, referencing the idea that rental property owners would likely adjust tenant rent costs to reflect any tax increase. “That would spread it to everybody that lives in the district.”

Voters in the Vandalia-Butler school district voted in May to reject an additional 1% income tax to fund school operations. That tax would have lasted five years and generated about $6.4 million annually. Vandalia-Butler voters last approved a tax increase for daily school operations in November 2013 when a 6.99-mill property tax levy narrowly passed.

District officials recently pointed out that Vandalia-Butler’s state funding per pupil was the second-lowest in the greater Dayton area in 2021-22, according to the Ohio Department of Education’s District Profile Report. Only Beavercreek was lower.

A similar calculation by the Dayton Daily News, combining both state and federal funding per student, showed Vandalia-Butler seventh-lowest out of about 45 school districts in the newspaper’s coverage area. That puts a higher tax burden on local property owners to fund the schools.

In a statement to this newspaper Wednesday, Superintendent Rob O’Leary said that the district has been working with state representatives about the need for more state funding.

“The district continues to advocate for change,” O’Leary said. “We recently met with Sen. Steve Huffman, Rep. Rodney Creech, and Rep. Phil Plummer to bring to light the funding shortfalls and the variances in the 2024 and 2025 biennium budget proposals.”

That state budget was to be finalized late Friday night.

“We found out the first year of my superintendency, six years ago, we were in the top 50 list of districts with the most funding lost by the state. From what we are seeing, to be 36th on that list now just doesn’t make sense. Ultimately, we are trying to figure this out and advocate for appropriate funding for our district. We appreciate the help from our state legislators in helping us get answers and advocate for appropriate funding.”

About the Author