The commissioners say through their fiscal conservatism they have amassed a budget carryover of around $50 million, some of which they said belongs in taxpayer pockets not the county coffers.

The county will not collect on its portion of property taxes, which add up to around $24 million. The Developmental Disabilities and Senior Services boards are also granting taxpayers a property tax break so all tolled property owners will realize a one-time reduction of around $151 per $100,000 of voted millage.

Commission President Dave Young said the robust fund balance, coupled with $46 million the county received in federal American Rescue Plan funds means the county is “incredibly flush with cash.”

“We should not have taxpayers’ cash sitting like that,” Young said. “So we decided to do a one-time tax holiday. We’re not reducing your tax rates, we’re not putting on, taking it off or anything like that, we’re simply not collecting next year.”

There is a caveat. Warren County Auditor Matt Nolan performed a mandatory property value reassessment on all properties this year and the average increase was 17%. Property reassessments do not automatically equate to increased taxes and increases and or decreases will vary depending on the market in a given neighborhood. Nolan said the rule of thumb is taxes go up by about half what the value increase turns out to be.

Young said the property reassessment is both good and bad because the average home in the county is $300,000 and with the re-evaluation home sellers can get about $51,000 more for their property.

“Essentially everybody’s taxes were going to be going up in 2022,” Young said. “So with us doing this tax holiday people’s taxes should be about the same. I say that coupled with the fact in 2023 they are going be more.”

The schools receive the largest chunk of property taxes and there are other levies like for the various fire and police departments. Those will remain unchanged. The county receives about $79 per $100,000 in home value annually, the DD Board collects around $46 and senior services $30. Nolan said those taxes amount to about $47 million of the reduction and the other estimated $3 million is coming from tax breaks from the Mason-Deerfield and Waynesville library districts and Turtlecreek and Washington townships.

“For a variety of reasons mostly because of these funds from other sources, whether it be federal, state, they’ve got more money than they need to operate and they’ve been building up balances,” Nolan said. “Rather than just keep building up those balances or just spending the money they decided the best thing to do is give back to the people that vote for them.”

The proposed county general fund budget for next is around $83 million and the commissioners say they can afford to give this tax grace period without impacting services.

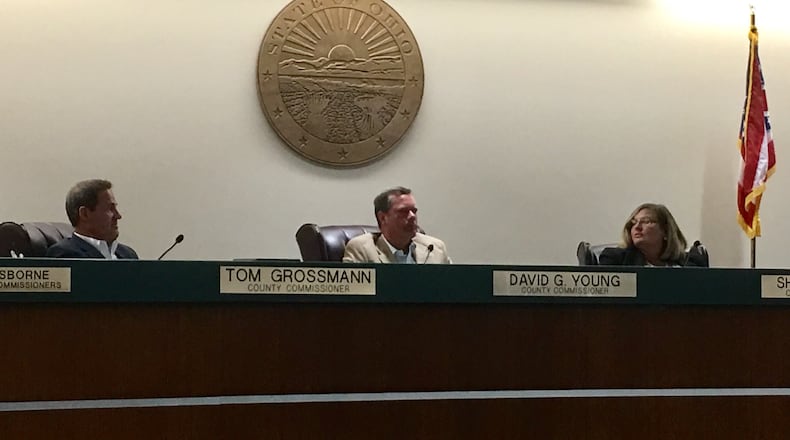

“We do not cut services ever, we never have,” Commissioner Tom Grossmann said. “But if we see that we do not have to tax at the level that we have been taxing on real estate taxes for the provision of certain services, and we can still maintain those services we cut the taxes and we’ve done that. We’re constantly looking for ways to be efficient while maintaining the same service levels.”

Commissioner Shannon Jones said there is no “connection” between the estimated $46 million they received in federal COVID relief funds but the tax holiday will help those struggling from the pandemic’s effects.

The commissioners have identified several projects and areas where they will apply the federal dollars such as addressing ongoing needs directly related to the pandemic, providing strategic investments to the county’s infrastructure like the water system and countywide broadband, and economic development efforts.

“From our standpoint it’s an opportunity to be able to invest back in community,” Jones said. “There’s not a connection between the ARPA dollars and the tax holiday. We took a wholistic approach to say we want to make sure residents and businesses are benefitting and as the economy is recovering from the pandemic that we’re in the strongest position possible.”

About the Author