RELATED: Greene voters to be asked to renew levies in November. Here’s what they would do

The levy will continue to cost homeowners close to $14 a year for every $100,000 value of property.

The money is needed to support the hospital’s operations and for buying equipment to support emergency, nursing, cancer and women’s health services, according to the county commission’s July resolution to put the issue on the ballot.

Resident Marcia Meyer O’Rourke doesn’t understand how a private company like KHN can ask for and receive tax support from voters.

“I support all of the people who work for Greene Memorial Hospital and its existence in general. What I don’t support is being taxed for it because it’s a privately held company.”

MORE: Xenia voters to decide on new street tax

Ohio Department of Taxation spokesman Gary Gudmundson said records show there are two half-mill hospital levies on the books in Greene County.

“Basically, the law allows county commissioners to spend general fund revenues (which is where the levy money goes) for the purposes of hospitalization,” he said.

Gudmundson said the state auditor’s office would be “most directly responsible for assessing the legality” of such a tax.

According to Beth Gianforcaro, press secretary for the Ohio Auditor's Office, state law allows "counties, townships and municipalities to seek levies in order to fund the health care at a local hospital for indigent patients."

Kettering Health Network bought Greene Memorial in 2009, according to KHN spokeswoman Elizabeth Long. Greene Memorial Hospital is a nonprofit organization, a 49-bed facility that employs approximately 400 people, hospital officials said.

Long issued a statement when asked about the privately-owned hospital’s request for tax support.

“Private, nonprofit hospitals are allowed to be supported by levies as long as the taxing authority approves it. In this case it’s the Greene County commission,” Long said.

The hospital is required to submit quarterly reports to the county, indicating how the levy money is being spent, according to County Auditor David Graham.

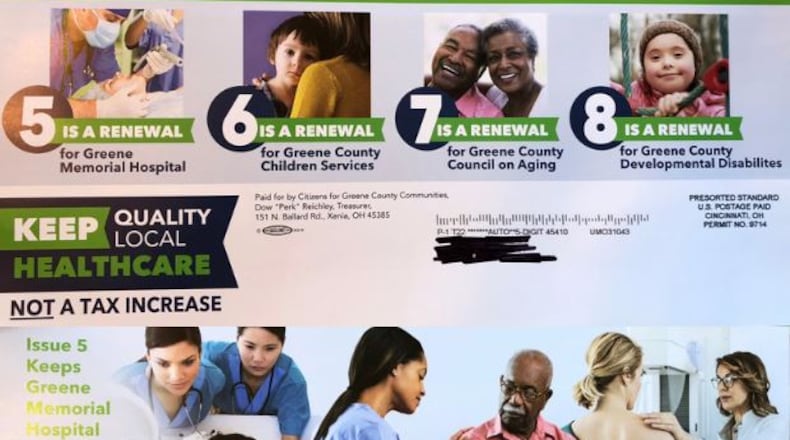

In July, county commissioners voted to approve the hospital levy along with three other renewal levies for the Nov. 6 ballot.

SEE ALSO: Crews demolish home where Greene County sex offender lived

In pro-levy mailers sent to county residents, Citizens for Greene County Communities lists the hospital’s levy with the other countywide renewal levies — Issues 6, 7, and 8 to support children services, council on aging, and developmental disabilities services.

“We have a responsibility to put it on the ballot so that the taxpayers can make that decision. I’m not opposing or endorsing any of these levies,” said Commission President Tom Koogler.

County Administrator Brandon Huddleson said the commission reviews the financial reports from the hospital, and Koogler followed, saying, “We are looking over their shoulders.”

In the conversation on the Vote for 5 Facebook page, the administrators for the page reply to questions from visitors, including one who asked why Greene County is the only county in the area paying taxes for a hospital owned by KHN.

STAY CONNECTED: Greene County News on Facebook

“Greene Memorial is actually one of several hospitals, including other Kettering Health Network hospitals, in the Miami Valley region to receive levy funding support. For instance, other hospitals receive it via health and human service levies so that they, too, can continue essential services to local residents who need them,” the administrator using the title For Greene Health Care responded.

Long later issued a second statement explaining why the levy is needed. A similar statement is used in response to visitors' questions on the Vote for 5 Facebook page.

“Kettering Health Network has made significant investments in Greene over the last 10 years, and continues to invest – but also asks each of its hospitals to be self-sustaining. To help Greene do this and remain up to date and viable, it counts on the communities and residents of Greene County to continue their investment to keeping local health services with levy support. This levy renewal will not increase taxes, but simply continues that investment ($1.15 a month per $100,000 of property value),” Long’s statement reads.

About the Author