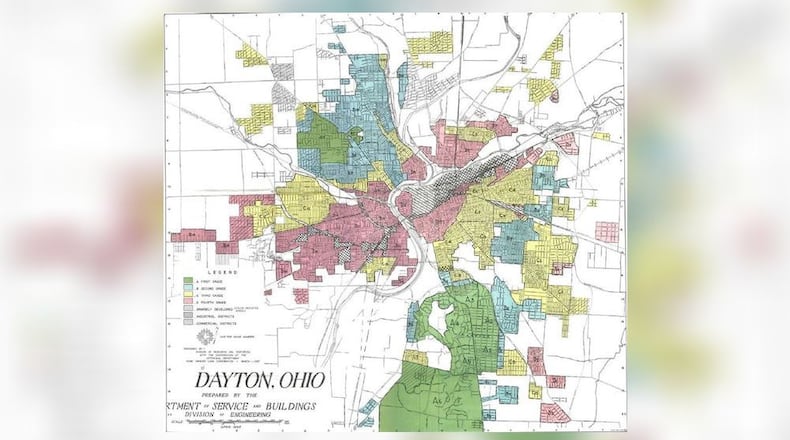

“Older section of city, negroes moving in,” they wrote.

A map of Dayton was created to help banks figure out which areas were more or less desirable for lending, taking into account factors including “infiltration” of Blacks and immigrants. The lowest-rated areas were outlined in red. The same was done in 239 cities across the U.S., and the term “redlining” was born.

The effects of this now-illegal practice are still felt today, according to Jim McCarthy, president and CEO of the Miami Valley Fair Housing Center. He answered three questions about redlining:

1. What is redlining?

“Redlining is a practice by some lenders and/or insurers wherein an area either literally or figuratively has a red line drawn around it and the company then engages in an arbitrary practice of treating the people who live in the area differently. Treatment may be an outright denial of services, or provision of a more expensive, lesser quality service.

“Historically redlining has been practiced based upon the racial composition of neighborhoods and assumptions made about the socio-economic status of residents within the redlined areas. This practice stems from the establishment of the Home Owners’ Loan Corporation (HOLC) in the 1930s when color-coded maps were developed of cities in the U.S. that used racial criteria to categorize lending and insurance risks.”

2. What are the current laws regarding redlining?

“Redlining violates the Fair Housing Act of 1968, the Fair Housing Amendments Act of 1988, and the the Community Reinvestment Act of 1977. The Fair Housing Act makes it illegal to discriminate in the terms, conditions, or privileges of a rental or sale of a dwelling because of race or national origin. The Fair Housing Act was applied to the provision of homeowner’s insurance, using a clause in the act that says it is unlawful to ‘otherwise make unavailable or deny.’ Most homeowners cannot obtain a residential mortgage unless they can also secure homeowners insurance.”

3. What is the residual effect of historical redlining?

“The pernicious effects of historical redlining persist to this day. Residential mortgages in Black or Hispanic neighborhoods are more difficult to obtain and are often costlier; small businesses in Black neighborhoods or Hispanic neighborhoods receive fewer loans and the loans have lesser credit quality than small businesses in white neighborhoods. Even employment is affected since workers living in inner-city Black communities have more difficulty finding jobs than their suburban counterparts.”

About the Author