RELATED: District plans to spend $60 million on core problems

“This is a great accomplishment for the Dayton Public School district and for the taxpayers,” school district treasurer Hiwot Abraha said.

A bond rating estimates the financial strength of an agency, including its ability to make repayments when it issues debt.

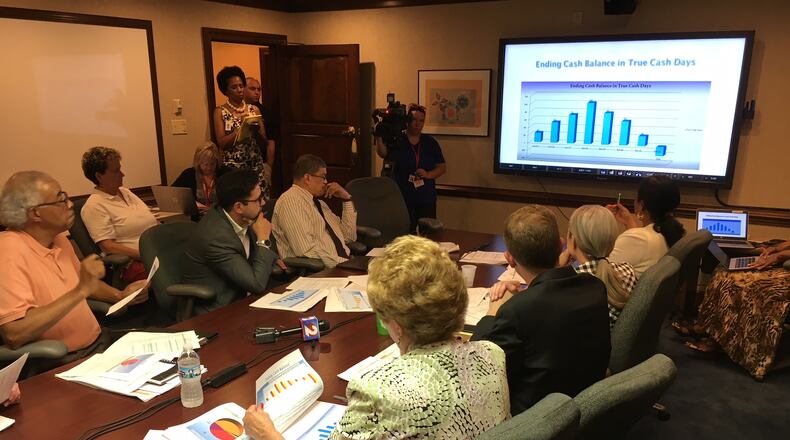

In its rating announcement, Fitch cited the district’s increased budget reserve levels as a key factor. DPS’ most recent five-year forecast, from late May, showed the district with $100 million in the bank, against a $257 million annual budget.

The school board has announced its intention to spend some of that reserve, on pay raises for staff, expanded counseling and busing options, plus repairs to school facilities. The board has debated the possibility of borrowing money for some of the longer-term capital expenditures. Better bond ratings can lead to lower interest rates and lower borrowing costs.

RELATED: Dayton schools consider borrowing money for projects

“The rating upgrades reflect Fitch’s assessment of the district’s improved operating performance,” the Fitch Ratings agency said in a statement. “The upgrades also recognize the improvements in budget management over the past several years of the economic recovery.”

In 2016, Fitch had lowered DPS’ bond rating two notches from an “A” to a BBB+ rating. At that point, DPS had $27 million in the bank, against a $225 million annual budget.

Fitch listed the rating outlook for Dayton Public Schools as “stable.”

About the Author