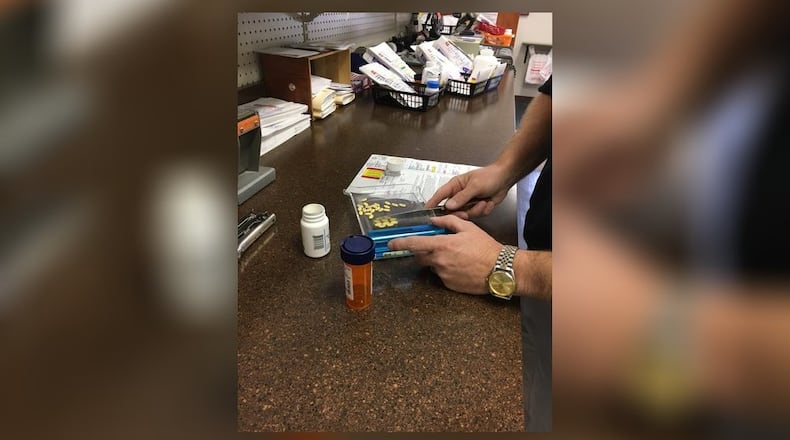

In 2017, the Dayton Daily News dug into the opaque tactics of these pharmaceutical middlemen, which critics say are one of the driving forces behind drug price increases.

RELATED: Consumer beware, drug discounts may contain catch

Pharmacy benefit managers say they save employers about 30 percent annually on their prescription drug costs because of their collective buying power and rebates negotiated with drug makers.

But there’s been a national backlash against these companies, which are accused of keeping money from rebates instead of passing those savings along to consumers.

FULL INVESTIGATION: Dayton Daily News digs into what drives prescription drug prices

In addition, the new Ohio rules prohibit health insurers and pharmacy benefit managers from charging consumers more for their prescription drugs than what it would otherwise cost without insurance coverage.

The press release stated that for example, if a consumer has a $20 co-pay for a prescription that only costs $10 if purchased without insurance, the consumer must be charged the lesser amount.

“Consumers have a right to better understand the cost of their prescription drugs and whether or not they can get those prescriptions filled at a lower cost,” Ohio Department of Insurance Director Jillian Froment said. “We require insurers and pharmacy benefit managers to act in good faith and to follow Ohio law, but these explicit prohibitions will make expectations clear and will protect Ohio consumers.”

IN-DEPTH REPORT: Consumers kept in the dark over drug pricing

Ohioans can contact the Ohio Department of Insurance at 1-800-686-1526 or visit www.insurance.ohio.gov to ask questions about their prescription drug coverage and to file a complaint if they feel their claims have been unfairly denied

About the Author