And another record indicates the county allegedly filed 2015 tax documents improperly, including W-2s and Form 941s.

Trending: UD student sentenced to jail for involvement in Penn State hazing death

The IRS penalized the county “as a result of an alleged improper filing of certain W-2s in a timely manner,” according to a letter sent last June to the county prosecutor’s office by Christopher F. Cowan, an outside attorney hired two months later by the county to contest the IRS penalty.

County commissioners approved spending $75,000 last August through the end of 2018 with Cowan, of the firm Cowan and Hilgeman, to assist the prosecutor’s office in “providing legal counsel and assistance” to the auditor’s office with “legal and tax issues with the Internal Revenue Service,” according to a resolution approved then by the county commission.

MORE: Reduced tax refunds surprising some filers

In January, commissioners approved another $24,000 extending Cowan’s services into 2019. And on Tuesday, they approved $25,000 to hire Terrence A. Grady and Katherine R. Dodson as special counsel to assist in resolving the appeal.

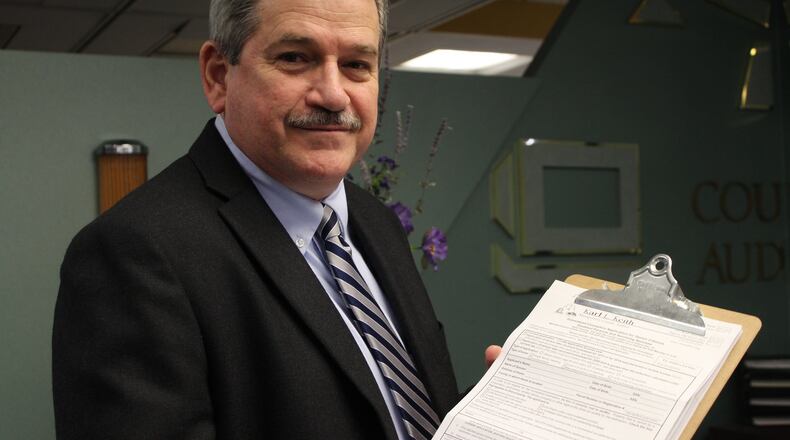

“The Auditor’s Office is responsible for tax filings with the IRS, and the county is party to an ongoing tax appeal with the IRS,” wrote Keith in an email Tuesday in response to Dayton Daily News questions. “The county has not paid any penalties to the IRS at this time, because this appeal is ongoing. We will not be commenting further about this issue until the appeal is complete.”

An Oct. 25 letter from Cowan to Montgomery County Prosecutor Mat Heck indicates Cowan sent a letter to the IRS requesting an abatement of the penalties assessed by the IRS over the late 2012 W-2 form filings and that Cowan expected the IRS to update the county on or before Nov. 17.

“If we get lucky and the IRS agrees with our abatement letter and abates the penalties, then the case will obviously be over,” Cowan wrote to Heck.

Cowan also told Heck of certain other IRS penalties also assessed the county for alleged improper filing of Form 941s and W-2s for the 2015 tax year and expected those legal fees to be additional and extend into 2019.

The extent of any progress in resolving the IRS issues remains unclear. It’s also unknown whether Cowan is being replaced, or if Grady and Dodson are working on other IRS-related issues separate from Cowan.

MORE: Back taxes sought on 1,614 properties in Montgomery County

The county did not respond Tuesday to a list of questions seeking those answers and others.

County Administrator Michael Colbert declined to comment Tuesday, referring questions to Keith, who provided the the short statement via email. The Montgomery County Prosecutor’s Office did not comment.

It also remains unclear which specific IRS deadline or deadlines the county missed. Typically, the deadline for businesses and government entities to file W-2s with the Social Security Administration (SSA) and distribute forms to employees is Jan. 31, according to the IRS and SSA.

Penalties can accrue for each day for each W-2 not filed on time, according to the IRS.

MORE: See what each community in the Dayton area will get from Ohio’s increased gas tax

Form 941s are an employer’s quarterly federal tax return used to report the income, Social Security and Medicare taxes withheld from employees’ paychecks. It is also used to pay the employer’s portion of Social Security and Medicare tax.

Montgomery County Commission President Debbie Lieberman said commissioners had few details of the IRS issues other than the prosecutor’s office recommended approving hiring the outside attorneys to assist with the tax issues.

“I don’t think I can say anything more because it could be potential litigation,” she said.

Keith was appointed county auditor in December 2000 and has been elected to four-year terms five times, most recently last November.

About the Author