The statewide group sometimes provides municipalities with such documents on matters it deems “significant,” OML Executive Director Kent Scarrett told the Dayton Daily News.

“It’s an important vehicle for our (local) legislative bodies to communicate to the public” on issues “that are going to be impactful to their communities, the region and the state,” Scarrett said.

About 80% of Ohio businesses are in municipalities, Scarrett said.

Part of an emergency bill approved in March after the coronavirus outbreak keeps Ohio workers paying income taxes to the municipality in which their employer is located at a time when more jobs are being done from home.

That measure – HB 197 – has been called unconstitutional by the senate bill sponsor and The Buckeye Institute.

SB 352 and HB 754 were introduced earlier this year. But state Sen. Kristina Roegner, R-Hudson, said she doesn’t expect her legislation to be voted before January and plans to re-introduce it in 2021.

“I think big cities would be well advised to start rethinking their budgets now,” Roegner said.

Both Scarrett and Dayton Mayor Nan Whaley have said the issue needs to be thoroughly examined.

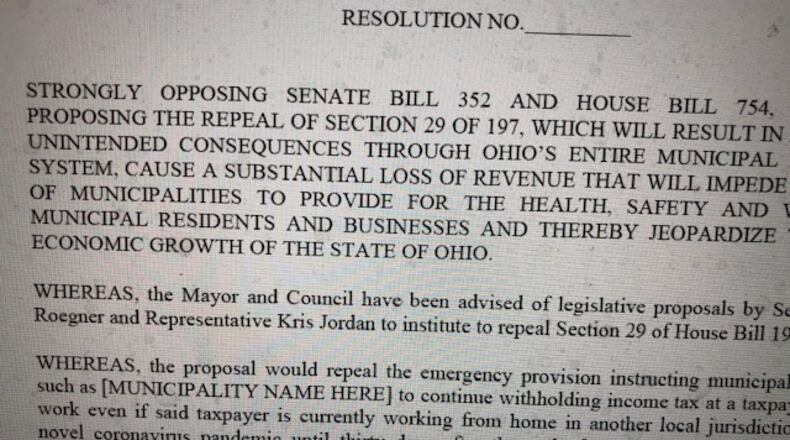

Passage of SB 352 and HB 754 “would hurriedly and radically change the long-standing municipal income tax collection structure throughout the entire state of Ohio during the ongoing COVID-19 pandemic,” according to the Ohio Municipal League.

Approval of the bills “would create substantial revenue cuts and destabilize the budgets of Ohio’s largest economic centers, jeopardizing the state’s economic competitiveness and stymieing future economic growth,” according to the OML’s resolution.

Meanwhile, “Ohio businesses would suffer the added administrative burden of tracking, reporting and remitting municipal income tax based on employee’s work-from-home locations,” it states.

In Ohio’s largest six cities – including Dayton - repealing the March change will drain up to $306 million annually from local budgets, one statewide group said.

Among other local municipalities, Centerville, Huber Heights, Kettering and Miamisburg all collect millions of dollars annually in local income taxes.

About the Author