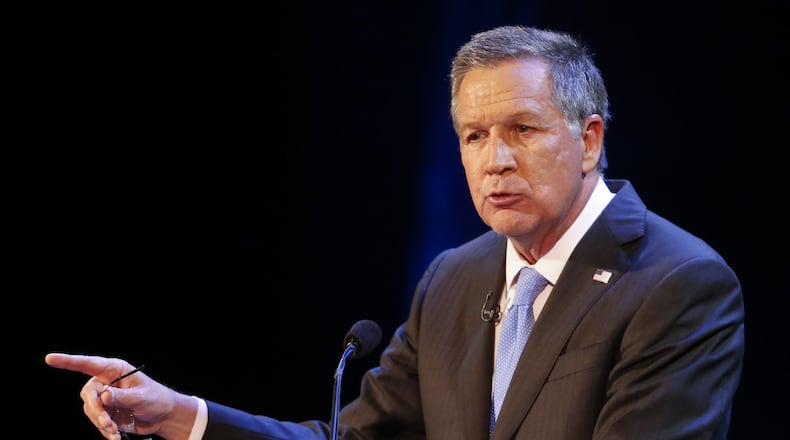

“This bill is not going to pay for itself; everybody knows that,” Kasich said. “As debt gets higher and higher and higher it slows the economy down.”

“So when you cut taxes to provide more economic growth, at the same time you drive up the debt — they kind of work kind of work in opposite of one another,” Kasich said. “And that’s why they now need to look at savings.”

The congressional Joint Committee on Taxation has calculated that the Republican tax bill will add $1 trillion to the government’s publicly held debt during the next decade.

The non-partisan Congressional Budget Office projects that even without the new tax bill, the government will add $10 trillion to the publicly held debt during those same 10 years, which is money the government owes to private and public investors who buy treasury bonds and other federal notes.

The Senate and House are expected to vote this week on the final version of the tax bill before sending it to President Donald Trump for his signature.

President Trump is defending the Republicans’ tax cut plan, pushing back against criticism that it will benefit the wealthy more than the middle class.

Trump said the middle class will benefit because the tax cut will draw companies back from overseas, creating jobs.

Trump touted the nation’s economy, predicting that it would “start to rock” once the bill is passed.

Trump also predicted that economic growth could go from the current 3 percent to “4, 5 and maybe even 6 percent ultimately.”

Many economists doubt that even a sustained 4 percent growth rate is achievable.

But Kasich’s call for cutting taxes while restraining spending creates something of a contradiction for him.

The only way to bring federal spending under control is to restrain the growth of the federal entitlements of Social Security; Medicare, which pays health costs for seniors, and Medicaid, which provides health coverage for low-income people.

Kasich, however, has relied on billions of federal Medicaid dollars made available through the 2010 health known as Obamacare to provide coverage for more than 700,000 low-income people in Ohio.

Kasich endorsed the bill’s call for slashing the corporate income tax rate from 35 percent to 21 percent, saying “the corporate tax rate in our country was way too high; one of the highest in the world. We needed to bring that down so that companies are going to invest in America and not invest overseas.”

In addition, Kasich warned against the possibility of the United States using military force to end North Korea’s nuclear weapons program. Pyongyang has tested a long-range missile which could reach the United States, although experts doubt North Korea has mastered the ability to attach a nuclear warhead to the missile.

“In the beginning I think the president by putting pressure on North Korea was doing the right thing,” Kasich said. “But it’s getting carried away.”

“And bluster and threats and throwing around the fact that we’re going to be engaged in some kind of a war that could involve nuclear weapons or result in the death of millions of people, I think is just not right,” Kasich said. “And I don’t think it’s not correct foreign policy.”

About the Author