“Making textbooks tax-exempt is one small step toward breaking down barriers to higher education,” said Rep. Sweeney, a Democrat from Cleveland. “Since colleges often require textbooks at skyrocketing prices to complete basic courses, it is incumbent upon state legislators to act to reduce the financial burden on Ohio students.”

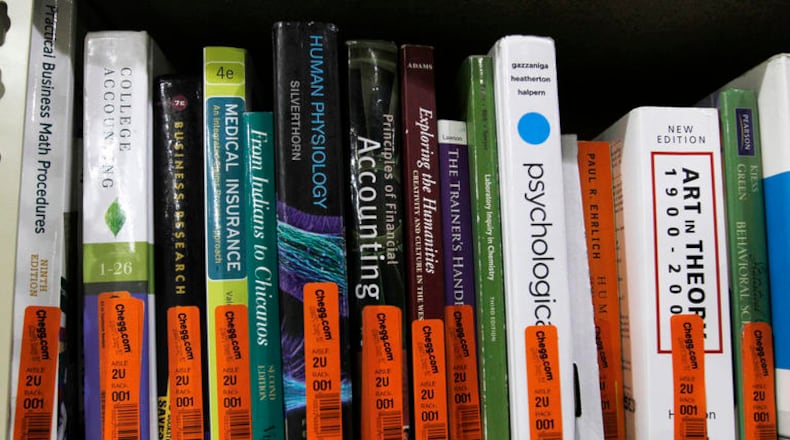

Antani said the rising costs of college are absurd and cited a recent study that found the average cost of a required college textbook is $97. At this cost, a student can feasibly spend thousands of dollars for textbooks over their entire college career.

Gov. DeWine signs law to eliminate sales taxes on feminine hygiene products

The proposal comes a month after the Ohio Senate voted 30-1 in favor of a bill that makes a slew of tax changes, including eliminating sales taxes on tampons and sanitary pads.

Antani, who was a proponent of the tax break on tampons, said each product that he’s supported to be exempt from sales tax has its own justification. As textbooks are a necessity to a student’s education, Antani said Ohio families should not be responsible for the sales tax and pointed to the fact that textbooks are free to students in grades K through 12.

Details emerge in CareSource network change

“Obviously, college costs are very high and becoming increasingly unaffordable for Ohians,” Antani said. “One of the ways to relieve college students and their families from the burden of college costs is to make college textbooks tax free. … We make our argument to fellow legislatures and to others. Some of them (bills) will pass and some of them will not.”

Although State Reps. Antani and Sweeney are optimistic that the bipartisan legislature could pass, Antani said it could still face opposition because it means less revenue for the state.

Columbus Business First reported that according to Ohio State, students are now spending an average of $1,168 a year on textbooks.

About the Author