A Household Pulse Survey conducted between Jan. 6 and Jan. 18 found that more than half of Ohioans who recently received a stimulus check ― which would be part of the second round of payments ― would use the money to pay off debt (54%).

More than a quarter of Ohioans (28%) said they would mostly save the money, and one in six residents expected to mostly spend it.

Some economists and anti-poverty groups say paying off debt and saving money is the right move for many people, and they recommend creating an emergency rainy day savings fund, in case of job loss, wage reductions or other economic hardships caused by the COVID-19 crisis.

“The ability to pay down debt with stimulus checks is a wonderful gift that helps families survive another day,” said Jan Lepore-Jentleson, executive director of East End Community Services on Xenia Avenue in Dayton. “But it’s only temporary. Next month they’ll probably find themselves in the same boat.”

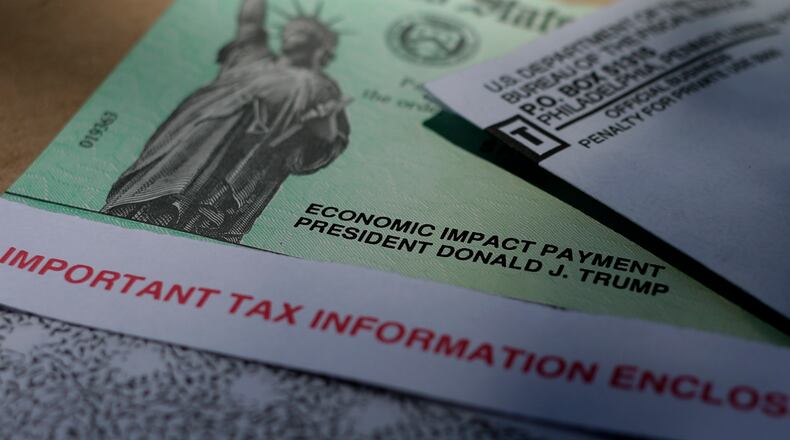

More than 6 million Ohio households received a first round of economic impact payments by last June that were worth a combined $10.1 billion, according to the IRS. The first payments were up to $1,200 per person and $500 per qualifying child.

The IRS and the U.S. Treasury began delivering a second round of direct payments in late December, worth up to $600 per person and qualifying child.

President Joe Biden and most Democrats in Congress support a new $1.9 trillion COVID-19 relief package that includes direct economic impact payments worth up to $1,400, which they claim will help struggling families and workers and small businesses in local communities.

“We need to invest directly in the people who make this country work,” said U.S. Sen. Sherrod Brown, D-Ohio, during remarks on the Senate floor late last month. “It helps people pay the bills, stay in their homes and get through this downturn.”

Some Republicans, like U.S. Rep. Mike Turner, R-Dayton, say direct payments have provided critical relief to families, and they support another round of distributions.

“People continue to struggle with the impact of coronavirus shutdowns, needing assistance for food, rent and support for their families,” he said. “The $1,400 payment has broad support in Congress, and I believe we should move this forward as quickly as possible.”

In mid-June, nearly two-thirds of Ohioans who received a stimulus payment or expected to receive one said they planned to use the money mostly for expenses like groceries, takeout, household supplies and personal care products, according to the U.S. Census experimental Household Pulse Survey.

About 17% of residents said they used or would use the direct payments to pay off debt, and about 18% expected to mainly add the money to their savings.

On average, Americans spent about one-quarter to one-third of their first stimulus checks in the first six weeks of receiving the payments, said Scott Baker, associate professor of finance with the Kellogg School of Management at Northwestern University in Chicago.

Many people decided to save most of the money they received or used it to pay down debts, said Baker, who analyzed how people used their payments, along with researchers from the Columbia Business School, the University of Chicago’s Booth School of Business and the University of Southern Denmark.

Stimulus spending habits varied across groups with different incomes and financial means, he said, and recipients with little money in the bank tended to spend more than half their checks while people with thousands of dollars in their accounts spent more like one-tenth of their payments.

“Those earning over $60,000 per year tended to spend only half as much as those earning $10,000 to $20,000 per year,” Baker said.

Stimulus recipients who spent the money tended to buy nondurables, food and make payments on loans, rent and mortgages, he said.

Baker said he suspects many people again will save most of their second stimulus checks until more of the economy reopens and people feel more comfortable going to places like restaurants, movie theaters and travel destinations.

“Because of all this savings, the stimulus checks aren’t really doing much to ‘stimulate’ the economy, in my opinion,” he said. “Some people are definitely in need of the checks, but since they’re relatively untargeted, they’re mostly going to people who still have their jobs and income and don’t have many places to spend the money.”

Credit: Liu Jie/Xinhua via Getty

Credit: Liu Jie/Xinhua via Getty

According to an analysis by Liberty Street Economics, there was a sharp increase in the U.S. personal savings rate early in the pandemic.

As of the end of June, about 29% of stimulus payments were used for consumption, 35% were used to pay down debt and 36% were put into savings, according to an analysis by the group , which publishes insights and analysis from New York Fed economists.

In a special August survey by the New York Fed, respondents on average expected to save about 45% of any second stimulus payments, use 31% to pay down debt and spend about 24%.

Families understand that saving to weather the next financial storm is prudent, and they will save money when they can, after paying their bills, said Lepore-Jentleson, with East End.

But very low income families who East End works with face exhausting challenges to meet basic needs for food, shelter and transportation, she said.

“Believe me, very low-income households are not spending their extra, precious stimulus dollars frivolously,” Lepore-Jentleson said.

About the Author